With the explosive global growth in ESG (environmental, social, and governance) investing, also known as sustainable investing, it’s no exception in China where ESG funds are proliferating and there are even Canadian offerings. One of ESG’s confounding aspects, however, remains that those three criteria mean different things to different people and that China in particular has its own self-serving views on what qualifies, analysts say.

Financial securities regulators are trying to warn investors and educate them on what constitutes ESG, but they are silent on Beijing using the sustainable investment movement to push capital toward companies that assist the Chinese Communist Party (CCP) in achieving its objectives.

Bloomberg, in a Sept. 6 article on China’s ESG growth, called it “ESG with Chinese characteristics”—the CCP designs the rules to suit itself.

“The [Chinese] government is bound to generate its own interpretation of ESG, because they want to make sure it will not conflict with the country’s national economic strategies,” Boya Wang, an ESG analyst at Morningstar Inc., says in the article.

The typical North American attempt at ESG qualification would be, for example, a company taking steps to reduce its carbon footprint or increase the diversity of its senior management.

“The Chinese Communist Party has made it clear that environmental and social policy fall under the purview of the government, not the country’s corporations,” wrote Bradford Cornell, a UCLA professor emeritus and senior advisor with Reliant Global Advisors, and Jason C. Hsu, founder and chairman of Reliant, in a paper comparing ESG investing in China with that in the United States.

Cornell and Hsu explain that it pays for firms in China to “go green,” but those firms are not empowered to set policy.

The authors call ESG a “strange brew” and discuss how ESG scoring agencies often disagree on whether or not a company is “green.” In the case of a Chinese company that rates highly on social factors, it could be rated very poorly on those metrics by U.S. definitions, they say.

Canadian ESG investment offerings take their cues from these international dictates and norms.

‘Greenwashing’—Just No Word on China

Financial securities regulators have their hands full trying to crack down on “greenwashing”—misleading information about the green credentials of an investment product.

“Investors currently lack a consistent and comparable framework to enable their understanding of sustainable finance products,” according to the International Organization of Securities Commissions (IOSCO) in an August 2022 report.

But the organization is not warning about Chinese ESG in particular.

“IOSCO has no comment on China. However, we encourage asset managers globally to consider our recommendations,” spokesperson Carlta Vitzhum told The Epoch Times.

The Canadian Securities Administrators and Ontario Securities Commission published guidance in January about ESG greenwashing but did not respond to The Epoch Times specifically regarding the nature of Beijing’s co-opting of ESG.

A couple of Canadian ESG-focused exchange-traded funds (ETFs) are focused on China.

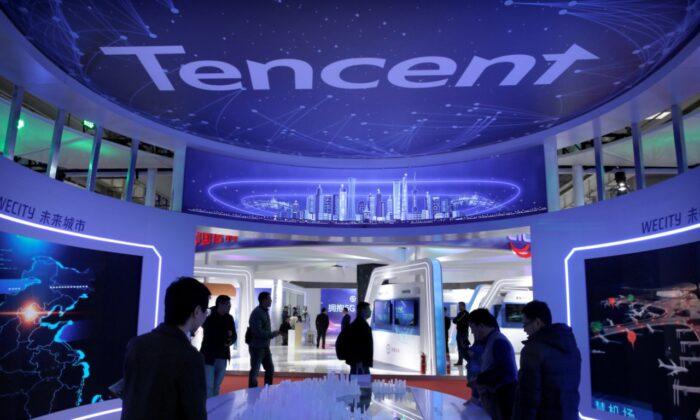

BMO’s ZCH ETF is designed to replicate the MSCI China ESG Leaders Index. As of Sept. 16, more than 56 percent of the fund was invested in Tencent, Alibaba, Meituan, and China Construction Bank—essentially a who’s who of large Chinese firms, which tend to be known for following the directives of the CCP.

The index deems a company eligible if it’s been assigned higher ESG ratings by MSCI relative to its Chinese peers.

Desjardins’ DRFE ETF, described as a responsible investing emerging markets low carbon dioxide fund, is a well-rated ETF by Morningstar that invests over 22 percent in Chinese companies including Baidu and China Petroleum & Chemical Corp.

Sustainable investing is also a big priority for Canada’s pension funds such as the Canada Pension Plan and Ontario Teachers’ Pension Plan (OTPP). These two are the largest Canadian pension funds and have been very bullish on China.

Jo Taylor, president and CEO of OTPP, told BNN Bloomberg on Sept. 8 that it wants to help businesses decarbonize and that while investing in China has been challenged recently, the Chinese market remains an important market in the long term.

Dark Side of Chinese ESG

China dominates the clean energy supply chain. It’s aiming for carbon neutrality by 2060–10 years later than over 120 countries, including Canada. Bloomberg reported that Chinese ESG fund launches surged in 2021 to address both environmental objectives and ones relating to common prosperity.

Among more than 170 ESG funds domiciled in China, about 15 percent are invested in coal companies, Bloomberg noted. Also, it pointed out that the CSI 300 ESG Leaders Index, China’s main ESG benchmark, may invest in firms with alleged ties to atrocities in Xinjiang.

For example, Bloomberg reported that about 10 percent of Chinese ESG funds hold Hangzhou Hikvision Digital Technology Co. Ltd., a company that creates video surveillance technology and that has been blacklisted by the U.S. entity list due to alleged human rights violations against Uyghur Muslims.

Republicans have raised the alarm about funding slave labour in China to buy solar panels.

“It’s illegal for the US to import material made with Uyghur slave labor. If the Biden admin is intent on expanding solar capacity in the energy grid, the least we should do is not finance one of our biggest geopolitical rivals using slave labor,” Ohio Republican congressman Bob Gibbs tweeted on Sept. 8.

Bill Flaig, co-founder of the American Conservative Values ETF, ACVF, in a recent commentary, said a company’s brand is damaged by the “hypocrisy of greenwashing, pandering to political issues, and ignoring inconvenient human rights and censorship issues.”

His fund doesn’t invest in companies that are hostile to conservative values and that support the “liberal agenda.”

“Look no further than the leaders at Coca-Cola and Nike, two companies that have both made shows of posturing against discrimination in the United States while remaining silent on the lengthy record of human rights abuses by the Chinese government. It’s an obvious discrepancy and everyone knows it, and it’s done nothing to endear either company to anyone outside of the activist class,” Flaig wrote.

He told The Epoch Times: “When we do have an international ETF, you can rest assured that we will not hold Chinese companies. (Someday, I hope things change and this won’t be the case.)”

The IOSCO said that assets under management by sustainable mutual funds and ESG-focused ETFs rose by more than 50 percent in 2021 to US$2.7 trillion globally, citing news and industry reports. “Green” assets are set to grow to $50 trillion by 2025 from about $35 trillion currently, according to one estimate noted by the IOSCO.

However, the average investor does not have a consistent framework to analyze these investments, let alone the added hurdle of the CCP’s brand of greenwashing.

“It should be noted that there is no common or generally accepted definition of sustainable finance or ESG, and not even a single definition or characterization of ‘environmental,’ ‘social’, or ‘governance’ factors,” according to the IOSCO report.

Friends Read Free