One month after U.S. House Speaker Nancy Pelosi (D-Calif.) visited Taiwan, the global financial markets’ concerns over a potential conflict in Asia have faded into the background as inflation and recession continue to dominate headlines.

Yet with heightened geopolitical tensions and various regional developments occurring in recent weeks, market analysts and investors are assessing the potential economic consequences of a China incursion into Taiwan and its possible effects on the equities arena.

Russia’s invasion of Ukraine led to an immense disruption in the international marketplace in 2022. Prices for crude oil, natural gas, and coal have skyrocketed. Europe is on the brink of a recession amid soaring energy costs. Food shortages are ubiquitous, especially in impoverished states that depend on imports from Russia or Ukraine.

Would a China–Taiwan war have a far more significant impact on global markets and disturb the worldwide economy?

A ‘Flashpoint’ for US–China Relations

Darin Tuttle, founder and CIO of investment firm Tuttle Ventures, has been saying since December 2021 that a conflict in the South China Sea was a large risk factor “underappreciated by the market.” For U.S.–China trade, this would be a “flashpoint” that would further deteriorate relations between the two juggernauts.

He noted that some of the outcomes might involve additional delisting of offshore-listed Chinese assets on U.S. stock exchanges and continued disruptions in global tech supply chains.

“Strategic competition between the U.S. and China is driving global fragmentation as both focus on boosting self-reliance, reducing vulnerabilities, and decoupling their tech sectors,” Tuttle told The Epoch Times. “The SEC is increasing disclosure requirements for Chinese firms listing in the U.S. The U.S. has also announced sanctions against Chinese companies undermining U.S. sanctions on Russia and is considering controls on outbound investment into China, either by legislation or executive action.”

According to Kunal Sawhney, CEO of equities investment research firm Kalkine Group, history suggests that an armed conflict and unrest between nations have typically led to a 10 percent to 20 percent decline in equity markets, with weaker economies taking the biggest hits.

“As the U.S. dollar dominates global financial flows, tighter sanctions could hit Chinese equities hard,” Sawhney told The Epoch Times. “Geopolitical issues like war are always bad for risk assets, including emerging market equities. So two markets that should be avoided right now are China and Taiwan. If China and Taiwan markets see a big fall, then it could also spread to equities in Korea, Latin America, South Africa, Russia, and Turkey, which have a high correlation with the above two markets.”

Within the emerging market basket, large U.S.-allied economies that maintain current account surpluses, such as India and Mexico, could emerge victorious in a contentious environment, he said.

Goldman Sachs strategists essentially minimized the odds of a conflict, maintaining their bullish position on Chinese stocks. Geopolitical threats might exacerbate near-term volatility, but fiscal and monetary stimulus efforts allow China’s economic outlook to remain bright, according to the bank’s analysts.

The Semiconductor Conundrum

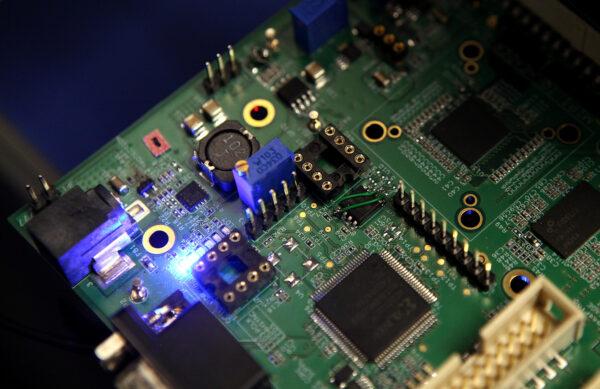

Any Chinese invasion of Taiwan would lead to a “scorched earth policy,” destroying the infrastructure in the semiconductor industry, according to Richard Gardner, CEO of financial technology strategic services firm Modulus Global.“While a Taiwan invasion would have global ramifications, funds that are tied closely to semiconductors see additional risk as this situation plays out,” Gardner told The Epoch Times.

Taiwan’s semiconductor industry is critical to the Chinese and global economies. The island nation represents nearly two-thirds of semiconductor manufacturing revenue. South Korea is a distant second, with fewer than one-fifth of the worldwide market share. China possesses only 10 percent of the semiconductor sector as it maintains a minimal capacity to manufacture chips, which experts argue is why Beijing only suspended imports of Taiwan’s citrus fruits and fish.

But China’s reliance on foreign technology may not be permanent as Chinese leader Xi Jinping promised to spend about $1.4 trillion by 2025 in high-tech industries, including semiconductors, as part of the government’s “Made in China” campaign.

“Nobody can control TSMC by force. If you take a military force or invasion, you will render [the] TSMC factory not operable,” Liu said. “Because this is such a sophisticated manufacturing facility, it depends on real-time connection with the outside world, with Europe, with Japan, with the U.S., from materials to chemicals to spare parts to engineering software and diagnosis.

Other Factors

Brookings Institution stated that Taiwan is becoming over-reliant on its semiconductor sector, calling it the “Dutch tulip syndrome.” As a result, with global macroeconomic conditions weakening, the Taiwanese economy’s outlook might also diminish simultaneously.At the same time, China’s zero-COVID strategy has been weighing on its economy. Chinese manufacturing and industrial production have been weak, retail sales grew less than expected in July, and the real estate market has turned fragile. China’s State Council recently unveiled its $146 billion stimulus package that targets infrastructure, private companies, and property. Interest rates were also cut last week to spur lending throughout the economy.

Friends Read Free