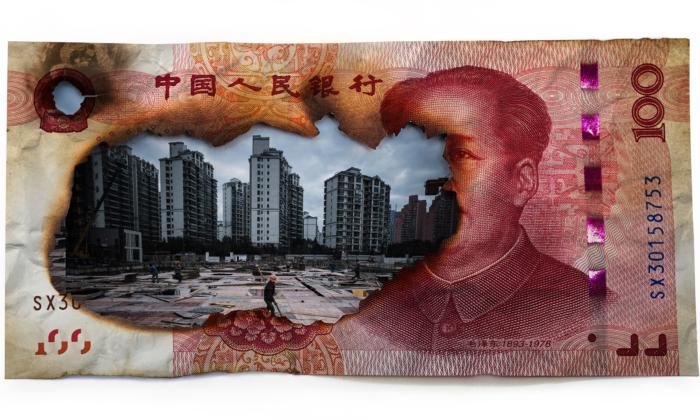

War bonds were once sold by the United States government to finance operations during World War II. Today, China has “virus bonds.”

Chinese companies have issued numerous short-term, cheap bonds to finance “virus control” efforts since the beginning of February.

Large portions of the economy are still shut down as the virus continues to spread and kill thousands. Companies are increasingly balance-sheet- and cash-constrained.

These virus bond funding programs, announced on Jan. 31, serve a dual purpose. They will provide funding to help control the outbreak as well as assist struggling companies to cover expenses until business activity picks up again.

These bonds, officially called “outbreak prevention and control bonds,” come with low interest rates—between 2 to 4 percent—and a quick approval process by financial regulators.

Alleviating Hard-Hit Industries

On the surface, virus bonds are a way to finance private-sector efforts in controlling the coronavirus, while shoring up company balance sheets. The interest rate is low, and duration is short—these bonds typically mature in six to 12 months, allowing companies to refinance these loans when the economy is presumably running again.As of Feb. 20, at least 28 companies have issued 33.5 billion yuan ($4.8 billion) worth of such bonds, according to a note by S&P Global Marketing Intelligence. Glancing at the bond information disclosures on the website of the Shanghai Clearing House, most of the issuer companies reside in hard-hit sectors.

Many companies who issued these bonds are from the transportation sector—such as China Eastern Airlines—and there’s a smattering of issuers engaged in the construction, development, energy, and consumer services sectors. Most bonds had annualized interest rates between 1 and 3 percent.

“We are one of the biggest victims of the epidemic,“ an official at Shenzhen Airlines told the Financial Times. ”What we need most is to reduce our financial burden,”

No Investor Demand

While necessary, mass issuances of these virus bonds signal that Beijing has given up on its recent deleveraging efforts to prioritize stimulating growth. The total size of the virus bond program, and how long Beijing keeps it running, will be telling.But from an investors’ perspective, these bonds have no secondary market.

First, the coupons on these bonds are below convention. The virus bonds’ low interest rates are not commensurate with risks investors must take to own the bonds. Virus bond issuers are typically financially strapped firms in hard-hit sectors or locations—not exactly the most creditworthy bunch.

In addition, the outbreak shows no signs of abating. The financial positions of these companies are likely to worsen before they recover. There’s no guarantee that these firms won’t default or go bankrupt before the coronavirus is contained.

“Market forces do not support the [virus bond] security,” a Hangzhou-based bond fund told the Financial Times.

For instance, Xiamen Airlines Co. on Feb. 12 issued 400 million yuan in virus bonds maturing in 177 days at 2.30 percent interest. According to S&P, the coupon is lower than the same bond (400 million yuan maturing in 176 days) Xiamen Airlines issued back on Nov. 27, 2019, which paid investors 2.55 percent interest.

According to market convention, there’s no way to justify a lower interest rate on its February 2020 bond issue. Without the virus bond program, investors would likely demand a far higher interest rate than 2.30 percent to reflect Xiamen Airlines’ weaker financial position driven by depressed passenger volume arising from nationwide travel restrictions.

Given this dynamic, currently, almost all bond purchasers are state-owned banks or investment firms. Many of these banks face their own unique challenges arising from the outbreak.

So virus bonds are nothing more than a temporary government-led bailout of virus-stricken companies.

Friends Read Free