SHANGHAI—Chinese investors dumped stocks in acquisitive sectors such as entertainment, media and IT on Nov. 19 on concerns new regulatory demands and a slowing economy could force heavy write-downs for firms that overpaid for assets during the boom years.

The massive goodwill sitting on the books of Chinese listed companies—roughly 1.45 trillion yuan ($208.87 billion) by some estimates—threatens to worsen the financial woes of many small firms already struggling under margin call pressure.

Goodwill—an intangible asset class arising from one company acquiring another for a premium value—has exploded following China’s mergers & acquisition boom in 2013-2015. Now, as China’s economy slows amid deleveraging and the Sino-U.S. trade war, regulators caution that goodwill would evaporate.

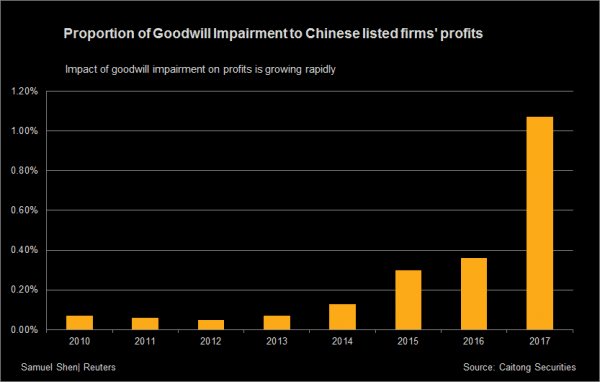

Proportion of goodwill impairment to Chinese listed firms’ profits:

Over the weekend, the China Securities Regulatory Commission (CSRC) tightened disclosure rules around goodwill, urging listed companies to conduct timely impairment test at the end of each fiscal year. Companies are also required to make “rational” assessment of the need for goodwill write-down, by taking into account factors such as prolonged deterioration in profitability, a worsening competitive environment, and macro-economic risks.

Sectors with significant goodwill assets fell sharply on Monday with leisure, entertainment, computers, technology, media and telecom sectors all down more than 1 percent at one point though most were able to claw back some losses. The start-up board ChiNext, home to many acquisitive firms, closed down 0.6 percent, compared with a 1.1 percent gain in the blue-chip CSI300 Index.

“Investors are worried that goodwill impairment will dent the earnings of those aggressive buyers during the M&A boom,” said Wu Kan, head of equity trading at Shanshan Finance.

Everbright Securities analyst Zhang Xu also cautioned that in an economic down cycle, the risk of goodwill impairment would surge as the acquired assets would likely fail to meet growth target.

Simei Media Co, Wanda Film and Glodon Software—once acquisitive firms with large goodwill assets—were among the biggest losers on Monday, falling 3 percent, 2.2 percent and 3 percent, respectively.

Market participants say the CSRC’s goodwill assessment tweaks could knock speculation out previously acquisitive parts of the market, just as it seeks to support struggling firms in other market segments.

Goodwill-related losses have already been climbing rapidly over the past few years. In 2017, China’s non-financial companies recognized 35.8 billion yuan in combined goodwill impairment losses, tripling from the previous year, according to data from Guosen Securities.

For example, battery maker Shaanxi J&R Optimum Energy Co reported a loss of 3.68 billion yuan in 2017, after writing down 4.6 billion yuan as goodwill impairment, a heavy price for its aggressive expansion.

The impact to companies’ 2018 earnings is not yet clear, but Liu Xiaolan, CEO of Shanghai Qianyi Certified Accounts Tax Co Ltd, said that in a slowing economy, companies’ goodwill impairment tends to get bigger.

($1 = 6.9422 Chinese yuan)

Friends Read Free