Zhuge Mingyang, an independent writer, told The Epoch Times that the seed problem is actually “a very terrible problem,” citing that some seed merchants, and even the government, have monopolized the seeds—in order to have enough seeds for farmers to buy every year—and used technology to inactivate the seeds. That is to say, some crops, fruits, and vegetables are either seedless or have seeds that exhibit weak germination.

Therefore, once a country has such a problem with its seed bank, it will not be able to grow food and vegetables, even threatening the globe, he added.

Moreover, corn, potatoes, and other crops are still partly dependent on imported seeds, and high-end varieties of vegetable seeds are mainly imported.

In addition, the feed conversion rate of pigs and milk produced by dairy cows are only about 80 percent of the international advanced level, also white feather broiler (chicken) breeders rely mainly on imports Tang said.

Imported Vegetable Seeds

Usually, foreign seeds are popular with Chinese vegetable growers for their high yield, quality, and return even if they are more costly, while the open-field vegetable growers choose Chinese seeds that are cheaper, the report said.

Japan is also one of the high-end vegetable seed exporters to China despite its incredibly high prices. Data by China’s customs office showed that in 2020-2021, the unit price of vegetable seed imports from Japan was nearly $247,000 per ton, tenfold higher than the global average of $23,000 per ton. Thus, the cost of Japanese vegetable seeds was 21 percent of the total in value while the volume was only 2 percent of China’s imported vegetable seeds.

Vegetable and grass seeds from the United States ranked among the top two seed imports to China. In 2020-2021 these two categories of seeds were up to three-quarters of China’s seed imports, both in terms of volume and value.

China’s vegetable seed imports is expected to reach 10,000 tons in 2021-2022, mainly comprising seeds for tomatoes, broccoli, carrots, onions, and spinach, the U.S. Department of Agriculture predicted.

A Surge in Demand for Grass Seeds

In recent years, grain consumption in the Chinese diet declined, while the proportion of protein foods such as meat, eggs, and milk climbed.One major protein intake is from grass-fed cattle and sheep.

Zhong Kang, a member of China’s Academy of Sciences told Outlook Weekly, a magazine run by Xinhua News Agency, on Jan. 17, China’s independently developed forage varieties can’t surpass the introduced varieties in quality, production, and resistance to adversity, which is why the country needs to import forage seeds for its commercial production.

According to Zhong, only 600 plus new forage grasses have been approved in China, of which two-thirds are imported varieties. More than 80 percent of alfalfa seeds, known as the king of forage grasses, need to be imported.

The United States was China’s largest source of grass seed in 2020-2021, with a 65 percent share, followed by Denmark, Canada, and New Zealand, with market shares of 10 percent, 9 percent, and 6 percent, respectively.

However, according to an assessment by the U.S. agriculture department, in 2021-2022 China’s imports from the United States of alfalfa, ryegrass, fescue, clover, and Kentucky bluegrass seeds will fall to about 55,000 tons, a 15 percent decrease from 2020-2021 partly due to reduced production in the United States after the main producing regions experienced a severe drought.

Seed quotes for fescue and ryegrass doubled by the end of 2021 compared to the same period the previous year according to insiders.

The U.S. agricultural department report cited officials from China’s National Forestry and Grassland Administration as saying the current annual production of grass seeds in China is about 90,000 tons, a 40 percent drop from less than 10 years ago.

One of the main reasons for reduced production might be the lack of competition. In the case of alfalfa, for example, the yield of Chinese seed is 450 kg per hectare, while the yield of Canadian alfalfa seed is about 1,000 kg per hectare. More than 70 percent of China’s imported alfalfa seed comes from Canada.

In addition, the value of grass seed is relatively low, and farmers cannot afford the high land prices in China.

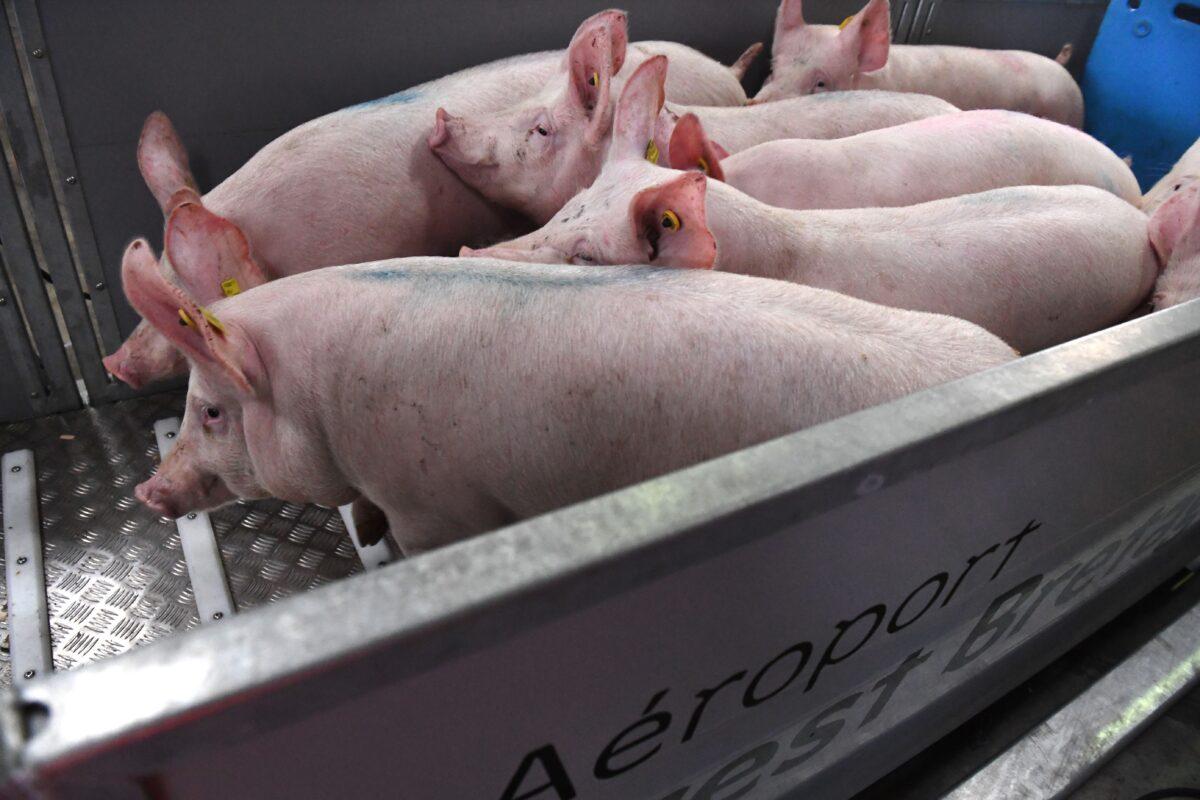

Reliance on Imported Breeding Pigs

Every year China imports a large number of high-quality breeding pigs to maintain its pig breeding capacity. According to a report released by Lead Leo, a Chinese commercial research institute, in 2020, more than 97 percent of pig breeds in China’s hog breeding sector rely on imports.

The report shows that in 2020, China’s pork consumption was about 46.9 million tons, which is 60 percent of China’s overall meat consumption and 46 percent of global pork consumption.

In contrast to local pig breeds, imported breeding pigs have high reproductive performance, a fast growth rate, low feed cost, and high economic efficiency.

In 2020, China imported 20,000 original breeding pigs at an average price of 40,000 yuan (about $6,280) per head; the main sources were Canada, the United States, France, and Denmark according to the report.

The average feed conversion ratio of Chinese hogs is only 2.8:1, which is lower than the international average of 2.6:1; the number of weaned piglets per sow per year (PSY) is about 20, much lower than the level of 25-27 in the United States.

What’s more, the cost of raising pigs in China is much higher than it is in the United States as the Chinese pig breeding industry feeds the animals mainly corn and soybeans. China’s corn price was about twice that of theUnited States in 2020.

According to the report, Chinese breeding technology obviously lags behind that of foreign countries, and it will be impossible to independently grow breeding pigs that are of similar quality to European and American ones.

China’s demand for imported breeding pigs will continue for a period of time, said the report.

Friends Read Free