OTTAWA—The parliamentary budget officer says Crown corporations have handed out an estimated $422 million in “liquidity support” to businesses since the start of the pandemic.

Four Crown corporations account for roughly $236 billion in loans or deferrals handed out since the start of the pandemic to make it easier for businesses to manage costs.

The measures are mostly to be repaid, with just some portions of loans being forgivable, meaning they are unlikely to have a large impact on the federal deficit.

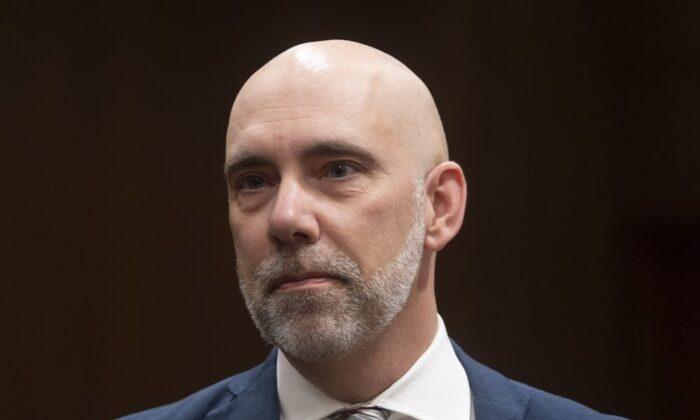

But budget officer Yves Giroux warns they represent a significant expansion of the government’s financial footprint and exposure to risk from bad debts that would hit Ottawa’s bottom line.

Even more problematic, he says, is the lack of public reporting of potential budget costs and risks.

Giroux says one outlier is the Bank of Canada, which reports weekly on its asset purchases, which have added $186 billion to the central bank’s balance sheet since March, not including about $234 billion in federal debt.