Experts are warning that Australia’s pursuit of efficiency coupled with a “she’ll be right” attitude has put the country’s fuel supply in danger. Many are also concerned that the federal government’s recent efforts to address the problem are not enough to eliminate any vulnerabilities.

The comments come as the Australian Parliament looks set to pass the Fuel Security Bill 2021, which will compel the oil industry to maintain stock levels above a certain threshold and solidify a government pledge to subsidise local refining operations.

Anthony Richardson, a research fellow at the Future Social Service Institute at the Royal Melbourne Institute of Technology, said Australian supply chains had been too focused on keeping costs low, which has eroded the resilience of the system.

Pursuit of Efficiency Leads to Declining Resilience

Formerly a net exporter of fuel Australia was once able to extract and refine all its petrol, diesel, or jet fuel domestically with 10 refineries operating in the country in 2000. However, as the decades rolled on, oil companies shut their plants in response to tougher economic conditions and declining profit margins.

“The existing Australian refineries are relatively small and old and have to compete against larger and more efficient refineries in the Asian region,” he wrote.

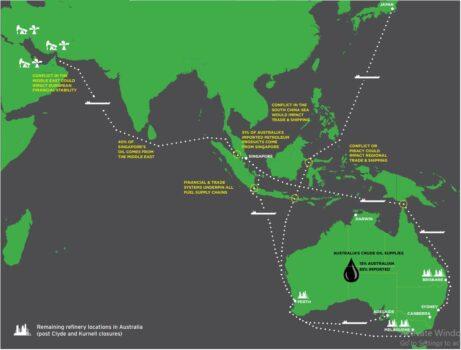

But these supplies are under increasing threat from the geopolitical competition that is currently encompassing the Indo-pacific.

Alexey Muraviev, head of the Department of Social Sciences and Security Studies at Curtin University, noted that “The global supply chain was set up on the premise that there would not be any disruptions to the international security environment.”

“This premise may have worked back in the 90s. But right now, in the second decade of the 21st century, we are seeing greater strategic competition,” he told The Epoch Times.

Graeme Bethune, CEO of EnergyQuest, an energy advisory firm, said complacency was a major issue, as well as a reluctance to intervene in the market as it could drive up fuel prices.

“There has also been a lot of opposition from the refiners and importing companies too. I think they’ve argued for years it’s not necessary (to store fuel) because the system worked well,” he told The Epoch Times. “They’ve done a good job, but the world is changing.”

Too Little, Too Late?

In response to the recent closures of ExxonMobil’s Altona and BP’s Kwinana, the government pledged $2.3 billion in taxpayer funds to support the remaining two refineries in Brisbane (Ampol) and Geelong (Viva Energy).

While experts have welcomed the moves, they believe that larger fundamental changes were still needed.

Michael Shoebridge, defence director at the Australian Strategic Policy Institute, said it was “fortunate” to see the government prioritise the issue; but warned it was not enough.

“Any support to loss-making local refineries will not solve all of Australia’s fuel security issues—only a larger economic transition away from fossil fuels to energy sources that are available at scale locally will do that,” he told The Epoch Times.

“The total strategy has to be a combination of increased local storage, limited onshore refining capacity for the fuel types that are most necessary during crises, and a bigger, faster transition for the broader economy away from fossil fuels.”

Bethune called for a National Transport Policy to better determine the scope of the country’s petroleum needs, including an assessment of the potential uptake of electric vehicles; whether biofuels and hydrogen can be used to power vehicles; changes to the fuel excise; and the scope of rail electrification across the country.

Meanwhile, Daniel Wild, director of research at the free-market think tank, the Institute of Public Affairs, said the refining industry needed to be more investor-friendly.

“A key factor behind the decline of Australia’s oil refinery industry is over-regulation, red tape, and environmental activism, which has deterred investment,” he told The Epoch Times.

“What is remaining of Australia’s oil refinery industry would be killed off by a net zero emissions target which would make it impossible for Australian industry to compete,” he added.

Friends Read Free