The ruling Liberal-National Coalition government announced its 2018 budget on Tuesday, May 8, which introduced changes that it says will ensure sustained growth to the country’s economy.

The outline included budget-repair measures to bring down the country’s massive debt, but also some big spending measures, including tax relief for hard-working low- and middle-income Australians and schemes to provide a boost to older Australians.

The government has also announced that their predictions show the budget returning to a small surplus in 2019-20, a year earlier than planned and after almost a decade of debt and deficits.

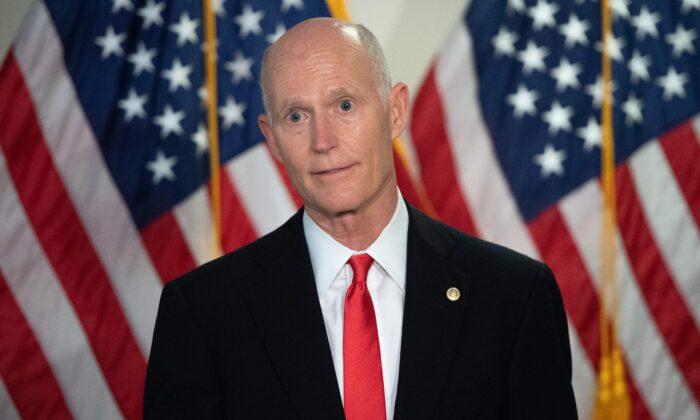

“We are no longer borrowing to pay for everyday expenses,” Treasurer Scott Morrison told reporters. “We have reached a turning point for debt.”

Morrison predicted a narrow budget surplus of A$2.2 billion in 2019-20, a remarkable turnaround on the A$2.6 billion deficit forecast by the government’s mid-year review in December. The projected surpluses increase to A$11 billion in 2020-21 and A$16.6 billion in 2021-22.

Net debt is seen peaking at 18.6 percent of Australia’s A$1.8 trillion gross domestic product (GDP) in the current 2017-18, before falling to 3.8 percent by 2028-29.

Morrison maintained the government continued to “live within its means” despite the budget spending splash.

Sustained Growth

Australia’s economy, which has outperformed many rich world peers since the 2008 global financial crisis, has now entered a 27th straight year of growth, but the pace has slowed significantly as the country recalibrates following the end of the China-driven mining investment boom.The government predicted domestic activity would accelerate at 3 percent annually through 2021-22, unchanged from December. Its outlook for unemployment and inflation were also unchanged.

Revelations of serious misconduct in Australia’s banking sector — during an ongoing inquiry the government initially resisted as unnecessary — have ramped up public scrutiny of the industry. However, the budget did not address that crisis in detail, saying only that the government would continue to roll out stronger penalties, powers, and enforcement for the sector.

Treasurer Using ‘Rosy Outlook’

A$13.4 billion four-year income tax package included immediate cuts for low- and mid-income households, and a proposal to flatten the overall tax structure by abolishing the highest income bracket, 37 percent, in 2024-25.Paul Dales, Capital Economics’s chief economist for Australia, said the tax cuts probably wouldn’t prompt the central bank to hike interest rates before late 2019.

“Overall, the treasurer appears to be using a rosy outlook for the economy to justify income tax cuts and an earlier surplus,” Dales said.

“We believe that low wage growth and a weakening housing market will mean the economy doesn’t live up to those high hopes.”

Along with low- and mid-income taxpayers, older Australian will also benefit from the new budget.

Pensioners will be allowed to earn up to $300 per fortnight — an increase of $50 — without impacting their pension under the Pension Work Bonus scheme. The cash boosts will be expanded to include self-employed retirees.

The Pensions Loan Scheme will be expanded to allow for older Australians to allow anyone over pension age to effectively mortgage their home to the Government to boost their retirement income.

The government will continue its A$75 billion 10-year infrastructure plan to build rail and road projects, and a A$30 billion five-year investment plan will go to hospitals.

![The Australian government's 10 year national infrastructure plan to reduce congestion, improve safety, and create jobs. (The Commonwealth of Australia [Creative Commons BY Attribution 3.0 Australia (https://creativecommons.org/licenses/by/3.0/au/)])](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2018%2F05%2F09%2FInfrastructure-map-large-600x503.png&w=1200&q=75)

Some Government Expenses to Lose Out

The budget included further budget-repair measures, with cuts to welfare, foreign doctors, and a continued hold of foreign aid at A$4 billion.The government hopes to reign in A$373 million in welfare spending in 2021 when it extends the income data matching activities between the Department of Human Services and Australian Tax Office in an attempt to enhance the integrity of social welfare payments.

It also hopes to save about $200 million by increasing the three-year waiting period for newly arrived migrants wanting to receive welfare benefits to four years from July 1.

The government is also determined to crack down on the black economy where it says many payments are falling outside the tax system. It will introduce a limit of $10,000 for cash payments made to businesses for goods and services to reduce the ability of black economy operators to use cash to avoid their tax and reporting obligations, and launder the proceeds of crime.

It hopes the new measures introduced to stamp out the black economy will bring in A$5.3 billion over four years.

The government is also projecting Australia a reduced need for foreign doctors at 200 fewer per year, which means a saving of A$415.5 over the next four years.

The marked improvement in Australia’s finances will likely be positive for the Turnbull government after a series of political setbacks. The budget is widely viewed as the unofficial campaign kick-off for federal elections due in the first half of 2019.

Friends Read Free