The prime minister says Saskatchewan residents will continue to receive carbon rebates despite his “disagreement” with the provincial government’s decision to withhold the carbon tax on home heating from Ottawa.

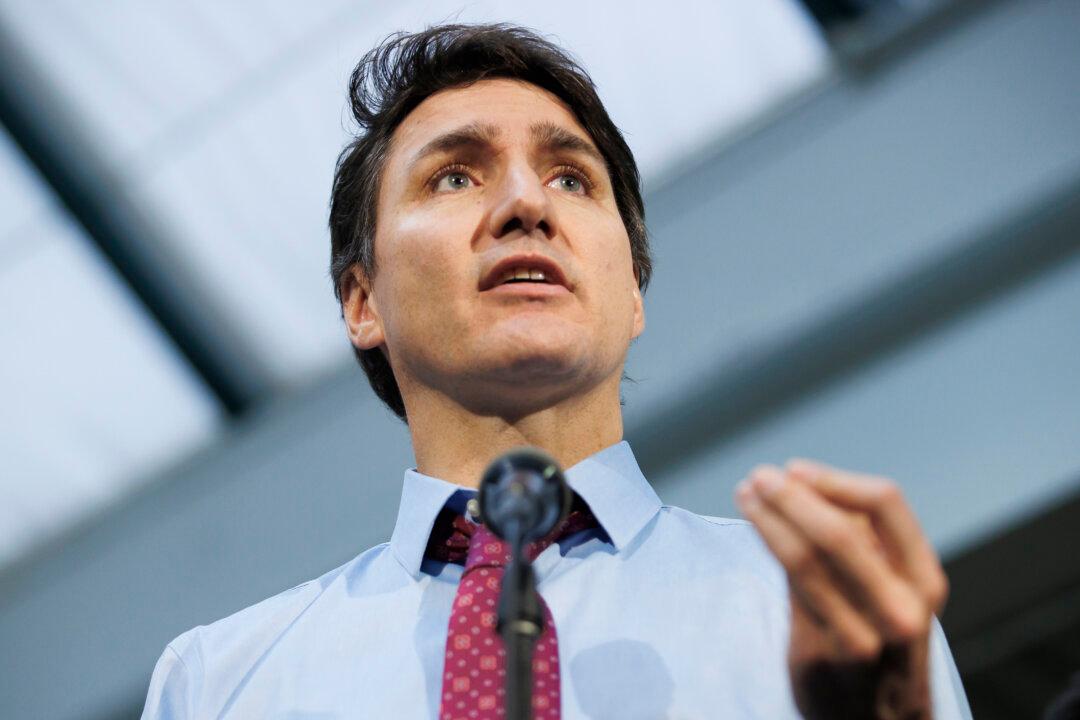

“We’re going to continue to deliver the Canada carbon rebate to families right across to Saskatchewan, despite the fact that Premier Moe is not sending that money to Ottawa right now,” Prime Minister Justin Trudeau said at an April 23 news conference in Saskatoon.