SPECIAL COVERAGE

Read More

Read More

Senate Advances House-Passed $95 Billion Foreign Aid Package

The package also includes a measure that would force TikTok to divest from its Chinese parent company over national security concerns.

Senate Advances House-Passed $95 Billion Foreign Aid Package

The package also includes a measure that would force TikTok to divest from its Chinese parent company over national security concerns.

Top Premium Reads

Top Stories

Most Read

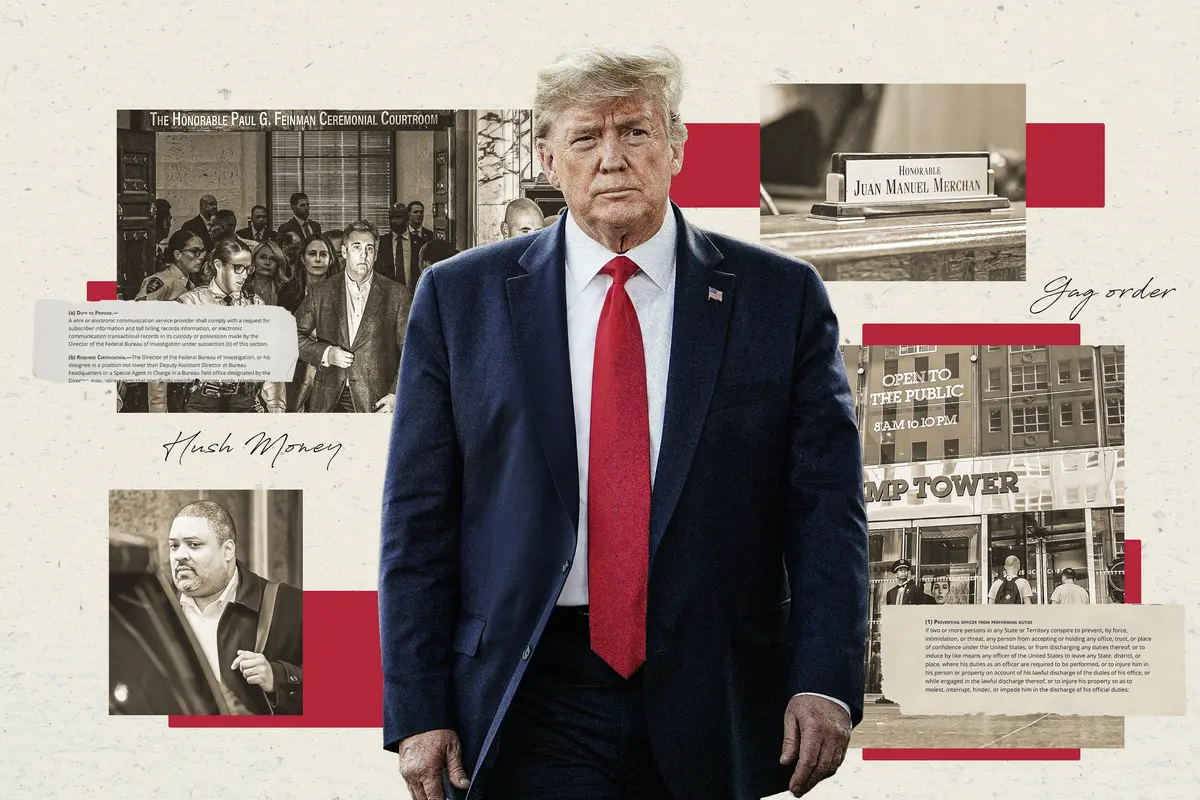

Testimonies Continue in Trump Trial With Ex-publisher David Pecker on the Stand

Prosecutors allege 10 violations.

Biden ‘Regulatory Smurfing’ Mires Oil, Gas Industry in Red Tape, Industry Leaders Say

Field hearing before all-Texas assembly of congressional Republicans criticizes administration’s ‘whole-of-government attack’ in forced green energy transition.

Biden Admin Agrees to Pay $139 Million to Victims for FBI Failures in Sex Abuse Investigation

‘The unfortunate reality is that what we are seeing today is something that most survivors never see,’ said Rachael Denhollander, one of his victims.

Tesla Laying Off Over 2,000 Employees in Texas Amid Global Workforce Slash

Tesla owner Elon Musk says the layoffs ‘will enable us to be lean, innovative, and hungry for the next growth phase.’

Biden Heads to Florida to Rebuke State’s New Abortion Restrictions

The campaign is also confident that President Biden can win Florida on more than abortion.

Trump Lawyer: Officials Want to Keep Trump Off Campaign Trail More Than Winning in Court

Another Trump lawyer claims New York judge doesn’t understand the case or “finance.”

Protein at Every Meal: How to Make Sure You’re Getting Enough

Getting enough protein has both short-term and long-term benefits for overall health and wellness.

Judge Unseals Documents Showing FBI Discussed ‘Loose Surveillance’ of Trump’s Plane

A large tranche of documents were unsealed by Judge Aileen Cannon on Monday, revealing the FBI’s code name for the probe.

Congressman Hit With Defamation Lawsuit From Ex-Biden Associate Tony Bobulinski

Mr. Bobulinski has paid for his own legal fees and is not affiliated with President Trump’s campaign, according to the filing.

COVID-19 Vaccine Protection Among Children Plummets Within Months: CDC Study

Agency says results show why it recommends kids get an updated shot.

Judge Approves Trump’s $175 Million Bond With New Restrictions in New York Civil Case

An agreement was reached between President Trump’s attorney and New York Attorney General Letitia James on the handling of the bond account.

Pennsylvania Primary Offers Window Into General Election

Interest in local and congressional races may bring out voters.

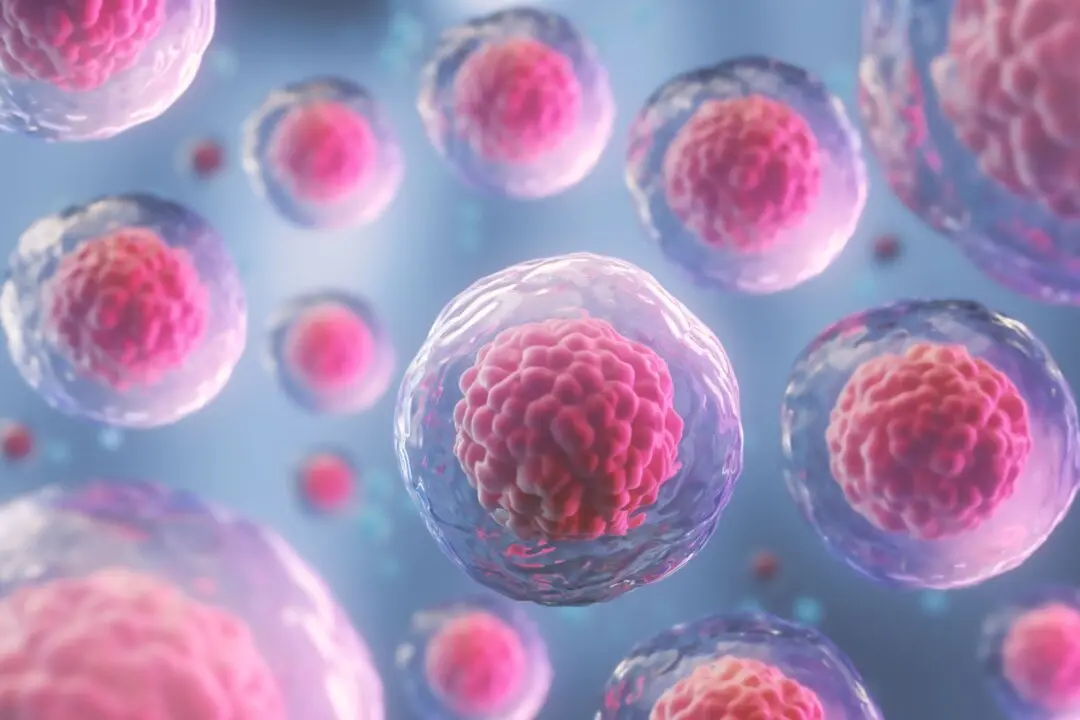

The 20-Year Debate Among 4 US Presidents: Embryonic Stem Cell Cloning

Advanced cloning technologies related to human embryo stem cells has triggered decades of serious debate among Presidents Bush, Obama, Trump, and Biden.

Trump Classified Docs Case: Unsealed Court Filings Show Emails Between NARA, Biden White House

Case file reveals FBI’s code name for it’s investigation into President Trump’s presidential records was ‘[Redacted] Plasmic Echo’

How to Make Your Own All-Natural, Skin-Nourishing Soap

Meg Hollar, founder of all-natural skincare company Bumblewood and co-host of The Hollar Homestead YouTube channel, shares a beginner-friendly recipe.

How to Make Your Own All-Natural, Skin-Nourishing Soap

Meg Hollar, founder of all-natural skincare company Bumblewood and co-host of The Hollar Homestead YouTube channel, shares a beginner-friendly recipe.

Epoch Readers’ Stories

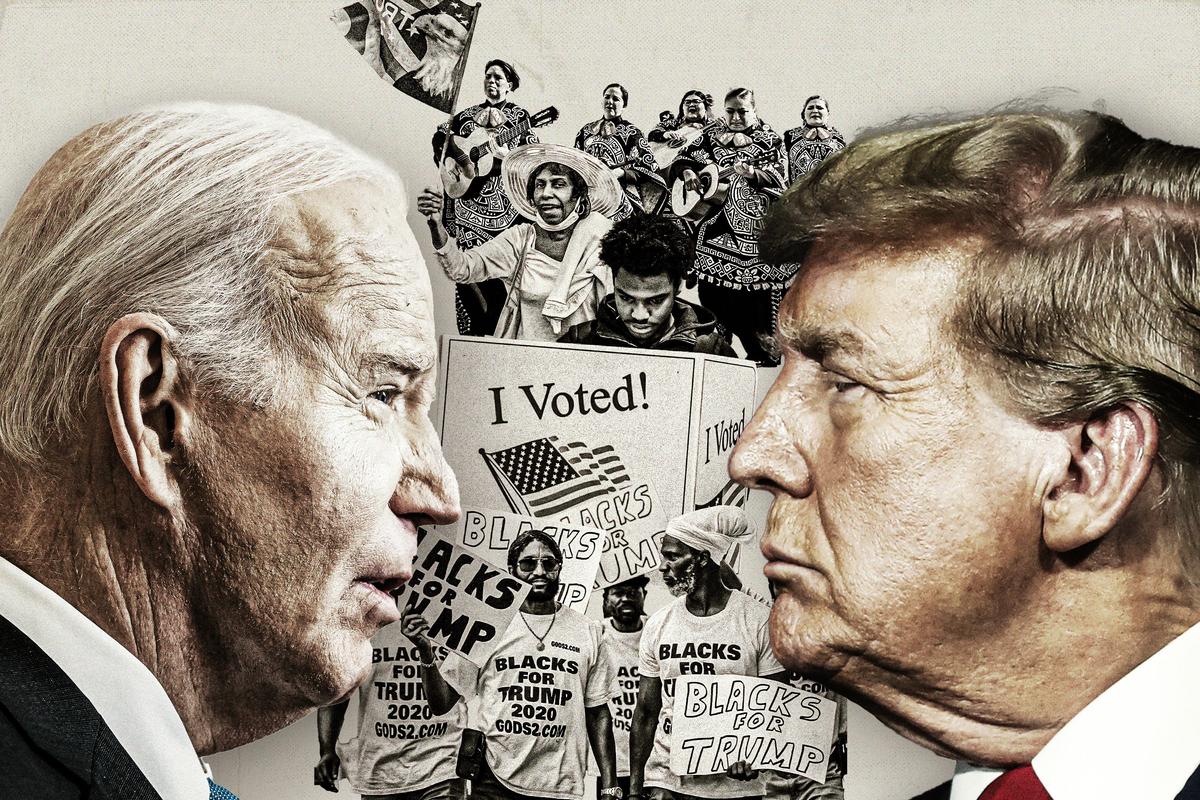

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Urban Adventures: Paddling in the City

You don’t need a remote mountain lake to enjoy the serenity of kayaking or paddle-boarding.

Special Coverage

Special Coverage

Trader Joe’s Basil Linked to Salmonella Outbreak

Twelve people in seven states have fallen ill from consuming the contaminated basil.

Trader Joe’s Basil Linked to Salmonella Outbreak

Twelve people in seven states have fallen ill from consuming the contaminated basil.

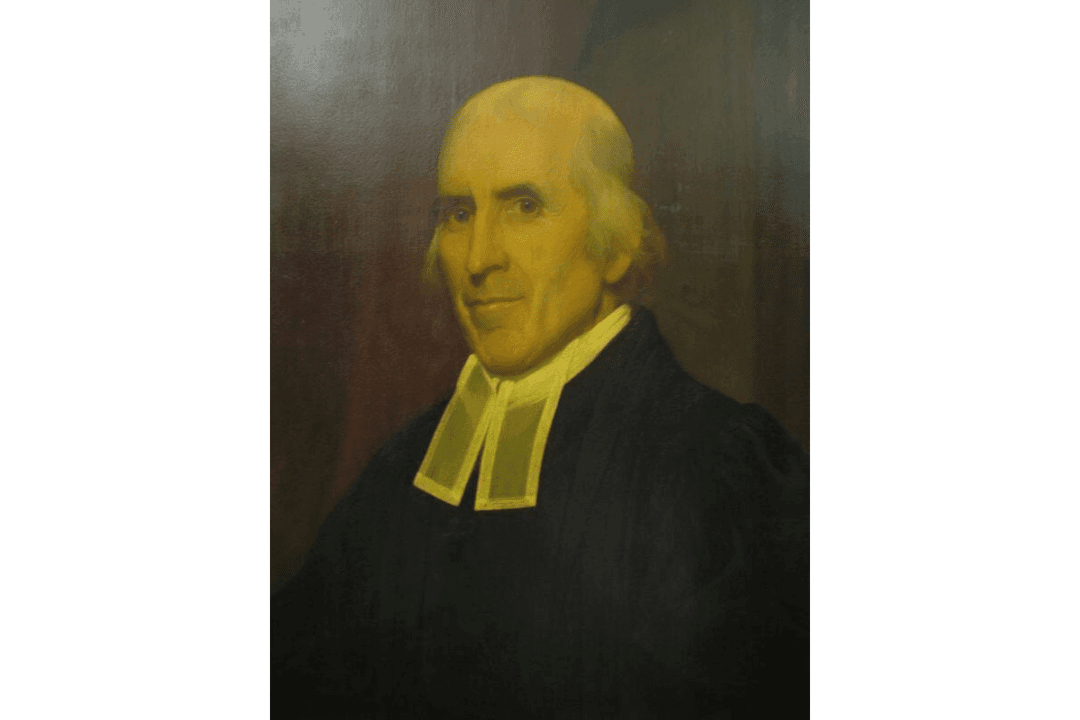

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

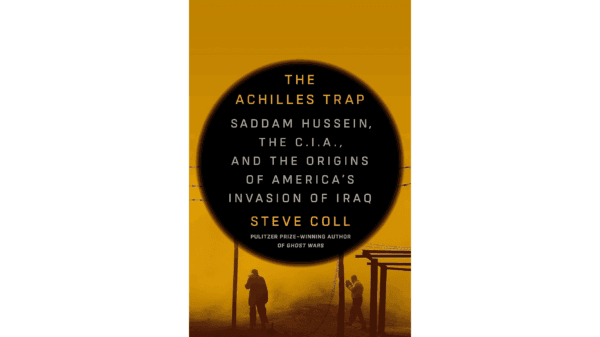

How the US–Iraq Relationship Devolved Into War

Decades of animosity swirl in Steve Coll’s ‘The Achilles Trap: Saddam Hussein, the C.I.A., and the Origins of America’s Invasion of Iraq.'

Vizcaya: A Classical Home a Stone’s Throw From Miami

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we see a home inspired by classic Italy in southern Florida.

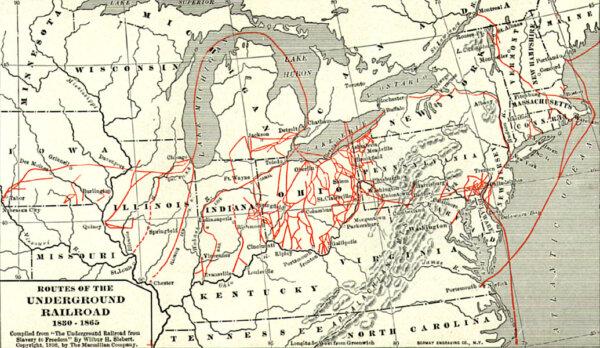

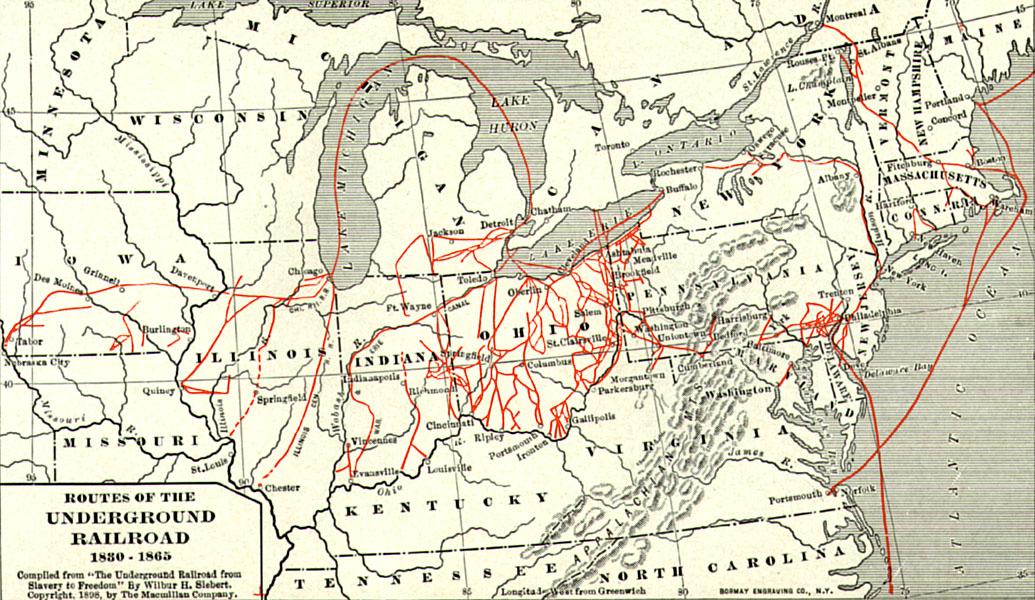

Important Players in a Divided Nation

Sons of the North, including young Spencer Kellogg, gave their all for the fight against slavery during the Civil War.

How a Minister’s Concern Birthed Our National Motto

In ‘This Week in History,’ US Treasurer Salmon Chase approved of an idea, early in the Civil War, that changed the history of American currency.

The Surprising Roots of Indoctrination by Colleges

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

Alcohol and Acid

The acidity of the wine determines how well it will pair with food but labels often say nothing of acid levels.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

Rick Steves’ Europe: Glimpse the Ancient Past in Northeast England

Romans built Hadrian’s wall 2,000 years ago to mark the northern border of their empire.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

![[PREMIERING 4/23, 9PM ET] How Communist China Weaponized Interpol to Hunt Down Dissidents: Dolkun Isa](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635409-240421-ATL_Dolkun-Isa_HD_TN-600x338.jpeg&w=1200&q=75)