SPECIAL COVERAGE

Read More

Read More

Trump Advisers Meadows, Giuliani Among 18 Indicted in Arizona Election Case

The court documents also identified a ‘prior U.S. president.’

Trump Advisers Meadows, Giuliani Among 18 Indicted in Arizona Election Case

The court documents also identified a ‘prior U.S. president.’

Top Premium Reads

Top Stories

Most Read

Fauci to Testify in Public Hearing on COVID-19 Response, Origins

Dr. Fauci already testified in a closed door hearing and admitted there were serious systemic failures in the public health system during the COVID crisis.

Columbia University Students React to House Speaker Mike Johnson’s Campus Visit

Mr. Johnson called for the resignation of Columbia University President Minouche Shafik.

Pentagon Watchdog Opens Probe of DOD Funds to China for Pathogen Research

Outraged lawmakers are demanding answers about American tax dollars going to firms controlled by the Chinese Communist Party.

Police Arrest Anti-Israel Protesters on University of Texas Austin Campus

Hundreds of students walked out of class to protest in support of Palestinians, demanding the university divest from Israel.

Newsom, Lawmakers Introduce Bill in Response to Arizona’s Abortion Ban

The measure would let Arizona doctors operate in California until Nov. 30, assuming Arizona voters will approve an abortion measure on their ballot.

‘Go Back to Class,’ Speaker Johnson Tells Protesting Students at Columbia University

The speaker said he would call the president to demand he send the National Guard to shut down the protests.

Georgia Governor Signs Anti-Squatter Law, Making It Easier for Homeowners ‘To Go After These Folks’

‘It is nothing short of insane that there are some who are entering other people’s homes and claiming them as their own,’ Georgia Gov. Brian Kemp said.

Blinken Will Raise Human Rights Issue During China Trip, State Department Says

Blinken is in China for a three-day visit with a mission to press the regime to address a wide range of U.S. concerns.

Arizona House Votes to Repeal 1864 Abortion Ban, Sending Bill to State Senate

Three Republicans joined Democrats in repealing the law.

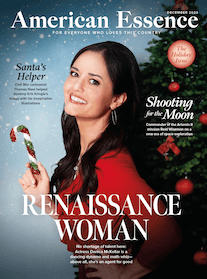

Editors' Picks

Judge Unseals Documents Showing FBI Discussed ‘Loose Surveillance’ of Trump’s Plane

A large tranche of documents were unsealed by Judge Aileen Cannon on Monday, revealing the FBI’s code name for the probe.

Trump Named as Unindicted Co-conspirator in Michigan ‘Fake Electors’ Case

Michigan Attorney General Dana Nessel filed charges last year against 16 alternate electors from the 2020 election.

Trump Asks Judge to Throw Out Two Charges in Georgia Election Case

The ex-president’s attorneys say the charges can only be prosecuted at the federal—not state—level.

Supreme Court to Hear Trump Immunity Appeal That Could Further Delay Cases

Experts say the high court may remand the case back to the federal court for further proceedings, a move that would give Trump a strategic win.

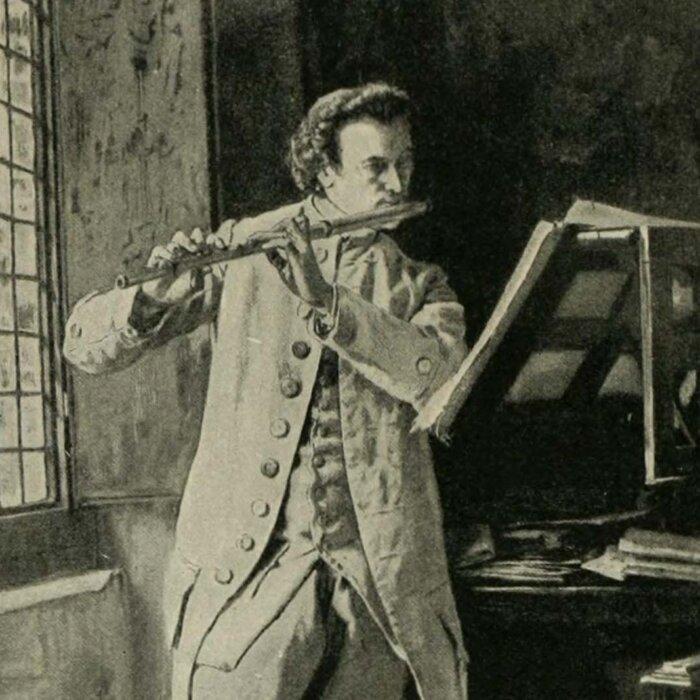

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Epoch Readers’ Stories

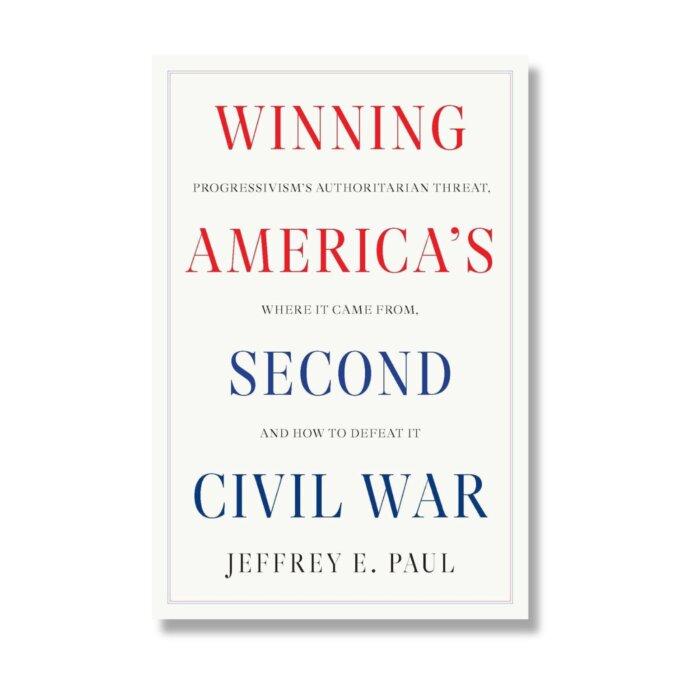

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Suffering Symptoms Caused By Prolonged Sitting? Try These 5 Exercises for Relief

Offsetting sitting with exercises throughout the day may alleviate and prevent pain and other consequences of prolonged sitting.

Suffering Symptoms Caused By Prolonged Sitting? Try These 5 Exercises for Relief

Offsetting sitting with exercises throughout the day may alleviate and prevent pain and other consequences of prolonged sitting.

‘Terrestrial Verses’: Censorship Up Close and Personal

Iranians face absurd suppression of their rights by bureaucrats.

Palazzo del Te: A Palace Near Mantua, Italy

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit a duke’s ‘pleasure palace.’

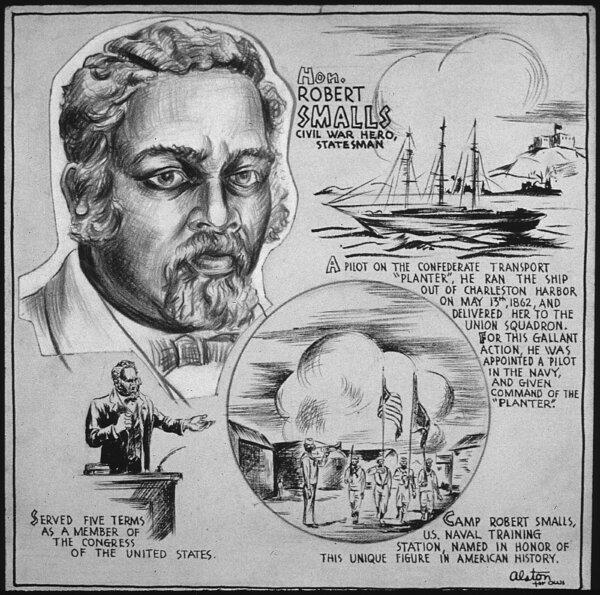

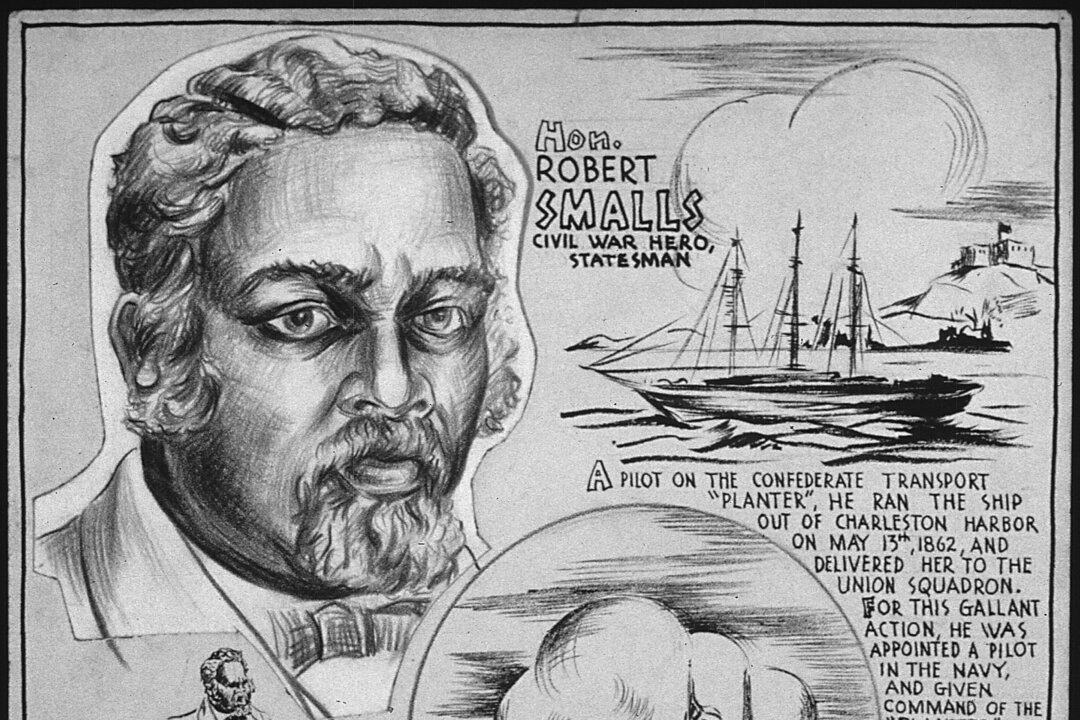

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

How Art Is Helping Veterans With PTSD

Artist Tim Gagnon gives veterans a way to move forward in civilian life.

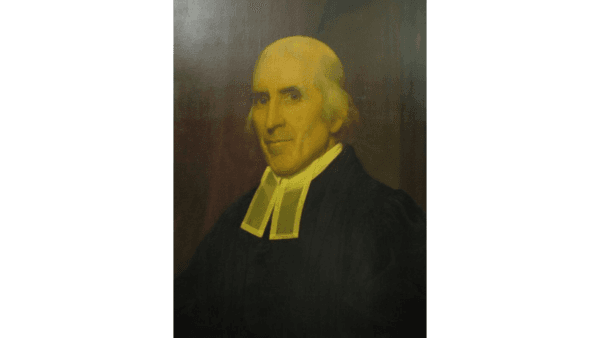

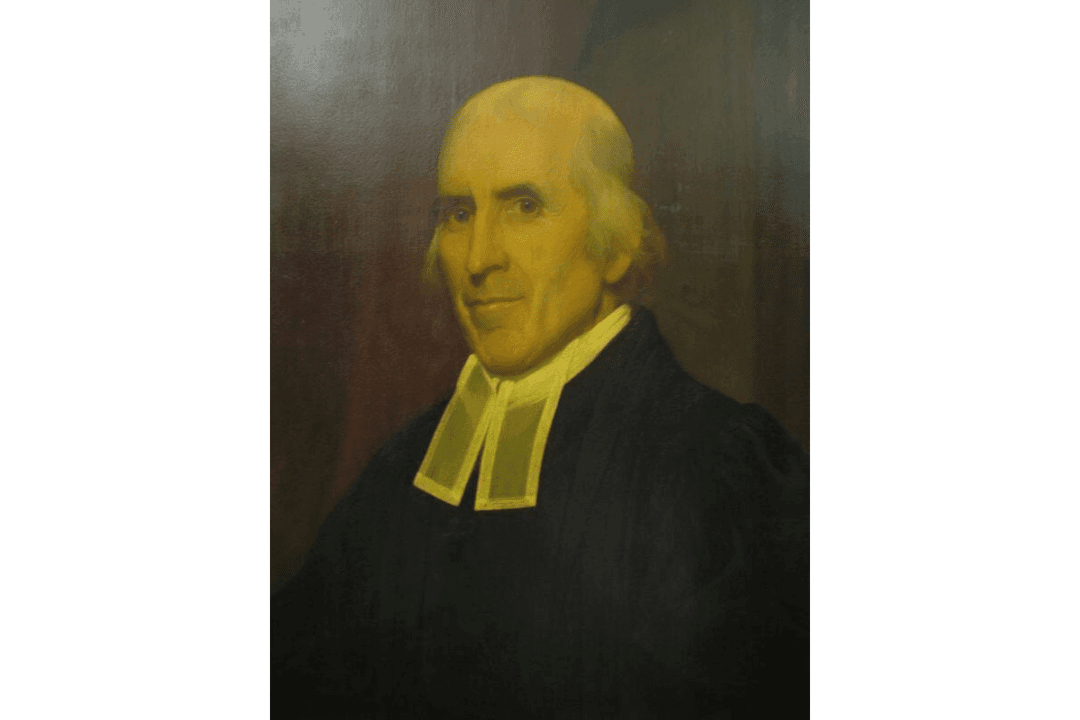

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

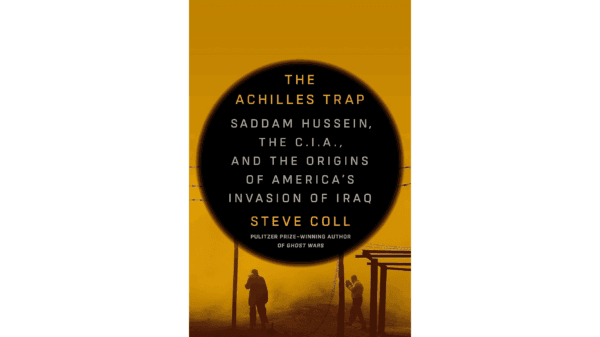

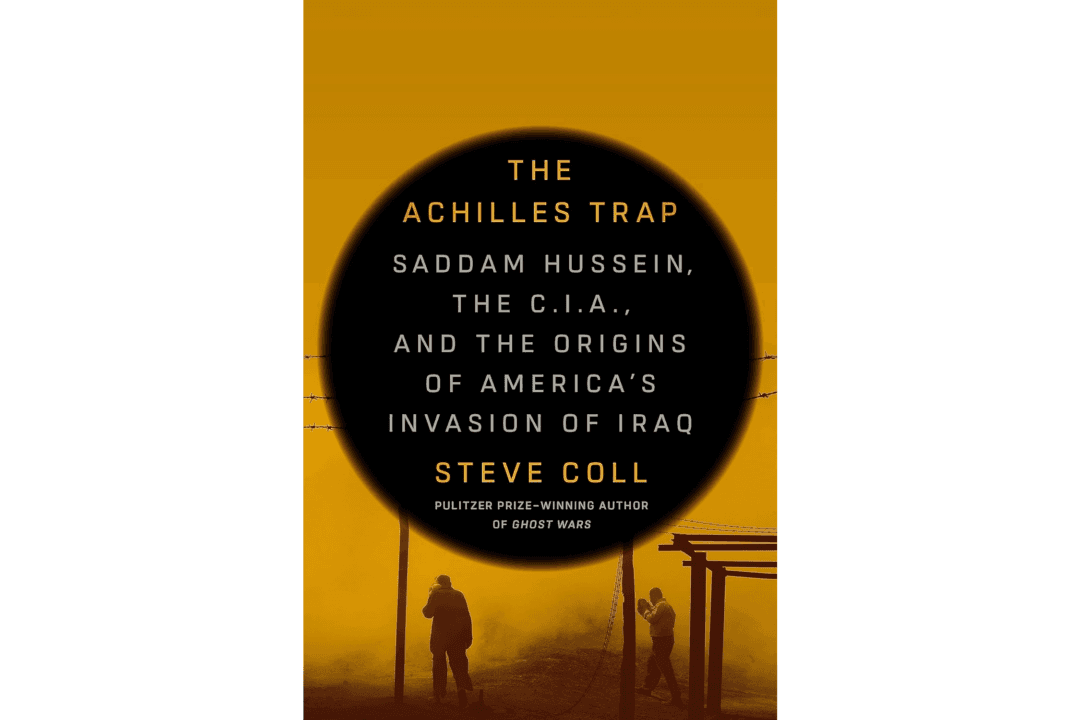

How the US–Iraq Relationship Devolved Into War

Decades of animosity swirl in Steve Coll’s ‘The Achilles Trap: Saddam Hussein, the C.I.A., and the Origins of America’s Invasion of Iraq.'

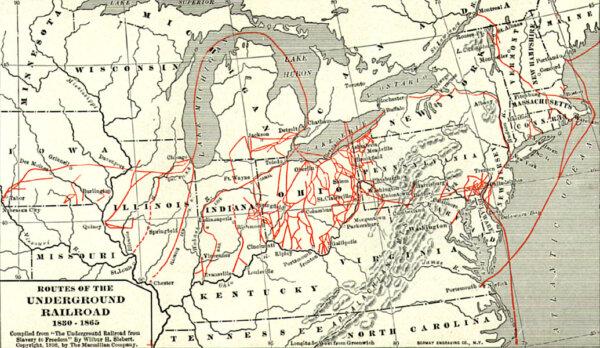

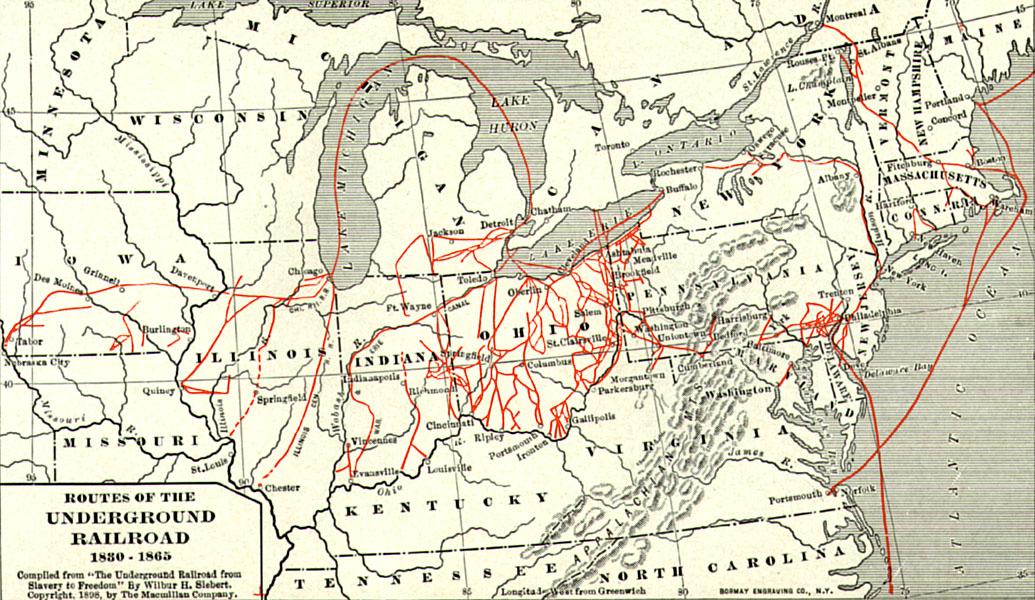

Important Players in a Divided Nation

Sons of the North, including young Spencer Kellogg, gave their all for the fight against slavery during the Civil War.

‘Terrestrial Verses’: Censorship Up Close and Personal

Iranians face absurd suppression of their rights by bureaucrats.

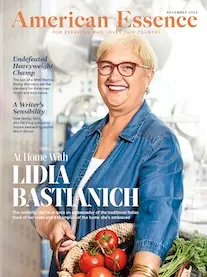

You Need a Kitchen Assistant

Your slow cooker can help you prepare a meal for less that two cents an hour.

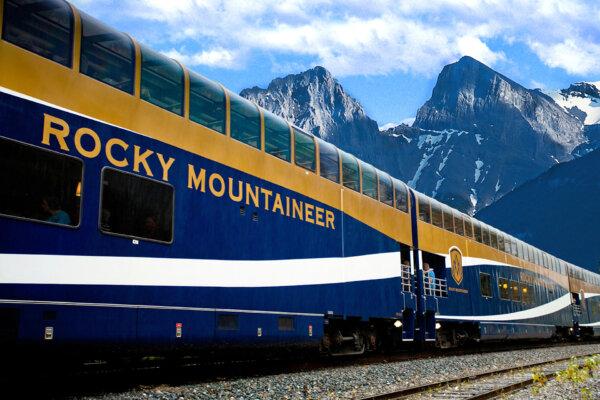

Rocky Mountaineer Train Launches Summer Season Promising Spectacular Views

Rocky Mountaineer has four routes that will take passengers through Western Canada and the American Southwest.

After 5 Years of Closure, ‘Glamping’ Back Again in Yosemite National Park

Camping hopefuls can now enter a lottery to experience three of the five available campsites.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

Rocky Mountaineer Train Launches Summer Season Promising Spectacular Views

Rocky Mountaineer has four routes that will take passengers through Western Canada and the American Southwest.

![[PREMIERING APR 26, 7:00PM ET] Hope for Israel | Special Report](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fthemes%2Feet%2Fimages%2FEET_default_700x420.jpg&w=1200&q=75)

![[LIVE Q&A 04/25 at 10:30AM ET] Why Is Australia Going After Elon Musk?](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F24%2Fid5636785-CR-TN_REC_0425-600x338.jpg&w=1200&q=75)