SPECIAL COVERAGE

Read More

Read More

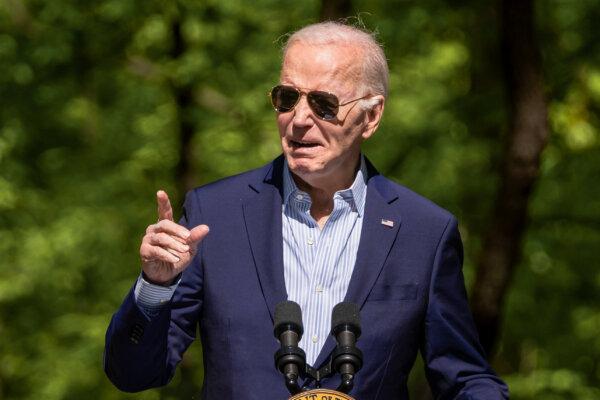

Biden Signs $95 Billion Foreign Aid Bill Into Law

The package includes aid to Ukraine, Israel, and Taiwan, as well as a measure requiring TikTok’s Chinese parent company to divest the app.

Biden Signs $95 Billion Foreign Aid Bill Into Law

The package includes aid to Ukraine, Israel, and Taiwan, as well as a measure requiring TikTok’s Chinese parent company to divest the app.

Top Premium Reads

Top Stories

Most Read

Georgia Governor Signs Anti-Squatter Law, Making It Easier for Homeowners ‘To Go After These Folks’

‘It is nothing short of insane that there are some who are entering other people’s homes and claiming them as their own,’ Georgia Gov. Brian Kemp said.

Blinken Will Raise Human Rights Issue During China Trip, State Department Says

Blinken is in China for a three-day visit with a mission to press the regime to address a wide range of U.S. concerns.

Arizona House Votes to Repeal 1864 Abortion Ban, Sending Bill to State Senate

Three Republicans joined Democrats in repealing the law.

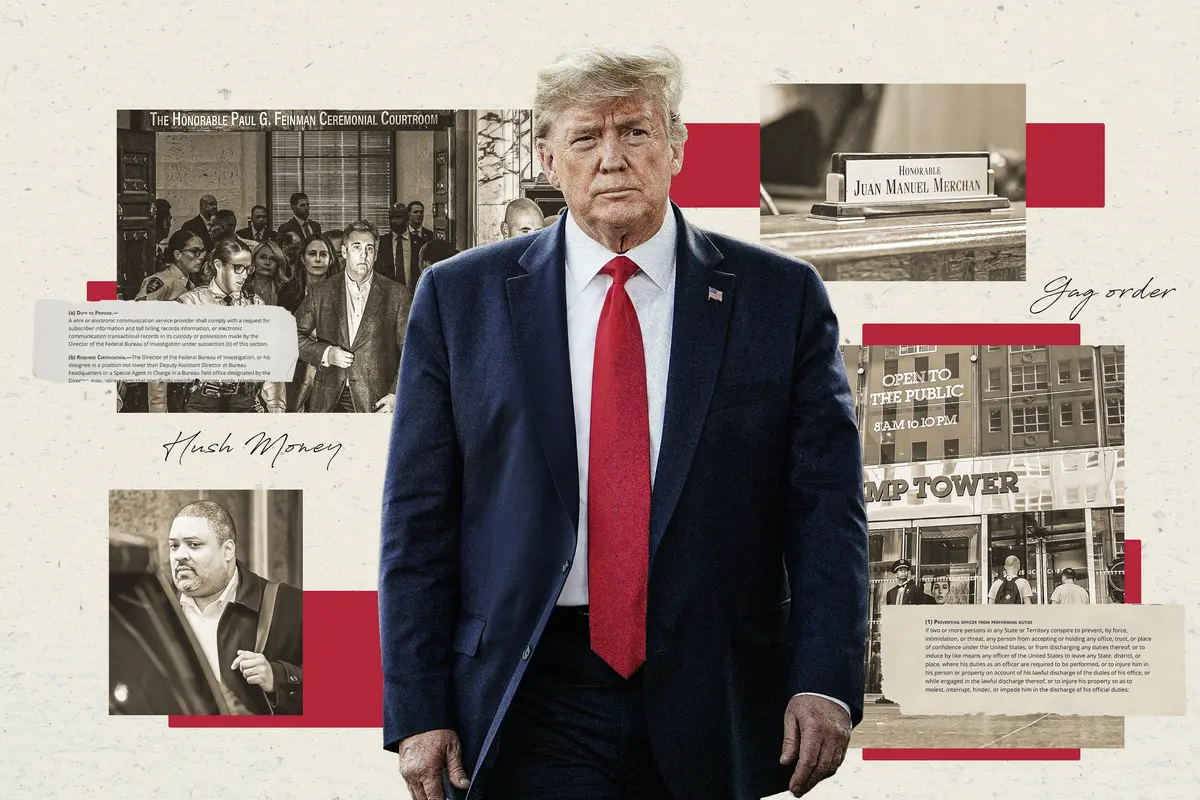

Trump Named as Unindicted Co-Conspirator in Michigan ‘Fake Electors’ Case

Michigan Attorney General Dana Nessel filed charges last year against 16 alternate electors from the 2020 election.

Dairy Cows Must Be Tested for Bird Flu Before Moving Between States: USDA

New order announced Wednesday.

Chinese National Sentenced to 9 Months in Prison for Threatening Pro-Democracy Activist

‘The defendant’s crimes are serious. He weaponized the authoritarian nature of the PRC government in order to harass and threaten Ms. Zoey,’ prosecutors said.

Trump Media Asks Congress to Investigate Market Manipulation Claims

The CEO of the company, which owns Truth Social, raised the ’troubling' concerns.

Democrat US House Rep. Donald Payne Dies at 65

New Jersey Gov. Phil Murphy confirmed the development on April 24.

Biden Administration Sued Over ‘Blatant Power Grab’ in Banning Worker Noncompete Agreements

The plaintiff called the ban ‘not only unlawful but also a blatant power grab that will undermine American businesses’ ability to remain competitive.’

Editors' Picks

Judge Unseals Documents Showing FBI Discussed ‘Loose Surveillance’ of Trump’s Plane

A large tranche of documents were unsealed by Judge Aileen Cannon on Monday, revealing the FBI’s code name for the probe.

Inside the Pro-Palestinian Occupation of Columbia University

It was Day Six of the ‘Gaza Solidarity Encampment,’ with hundreds of people, including students, sleeping in tents on the lawn of Columbia University’s campus.

Supreme Court May Rule for Starbucks in Labor Organizing Dispute

The coffeehouse chain is fighting a lower court order forcing it to rehire labor organizers whom Starbucks claims violated company policy.

The Return of Carob—This Time as a Functional Food

High in fiber and minerals and low in fat, carob—hailed as a “health food” in the 1970s—is making a comeback.

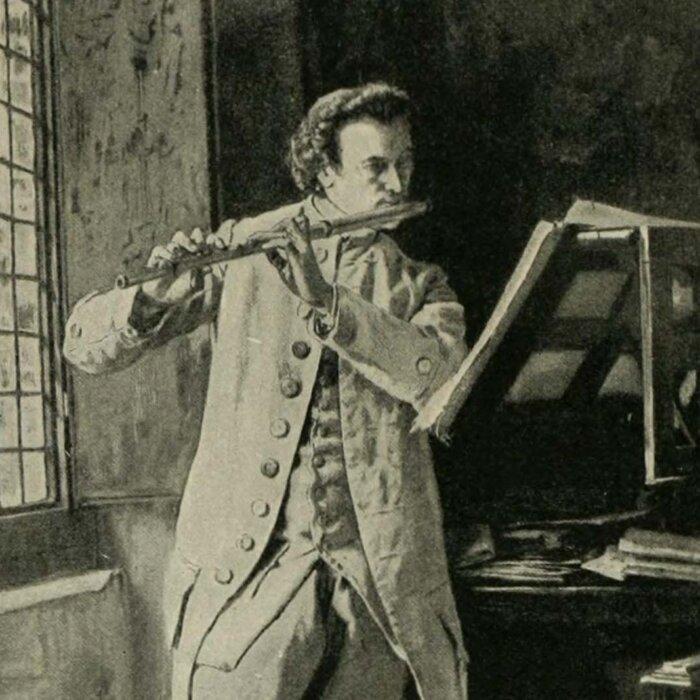

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Epoch Readers’ Stories

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Suffering Symptoms Caused By Prolonged Sitting? Try These 5 Exercises for Relief

Offsetting sitting with exercises throughout the day may alleviate and prevent pain and other consequences of prolonged sitting.

Suffering Symptoms Caused By Prolonged Sitting? Try These 5 Exercises for Relief

Offsetting sitting with exercises throughout the day may alleviate and prevent pain and other consequences of prolonged sitting.

‘Terrestrial Verses’: Censorship Up Close and Personal

Iranians face absurd suppression of their rights by bureaucrats.

Palazzo del Te: A Palace Near Mantua, Italy

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit a duke’s ‘pleasure palace.’

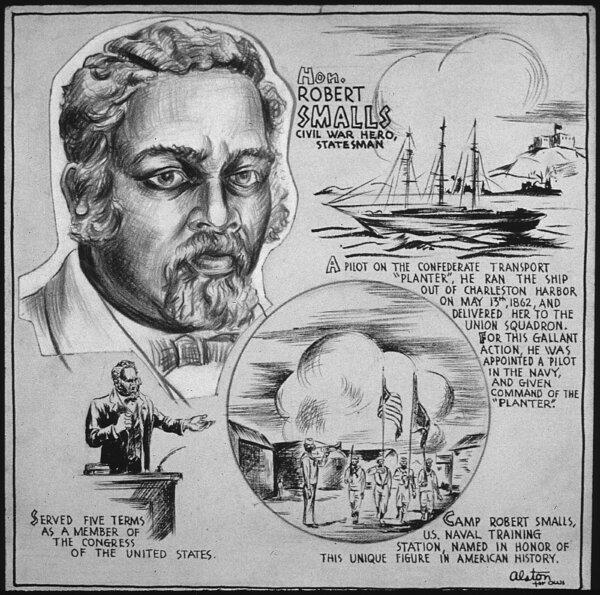

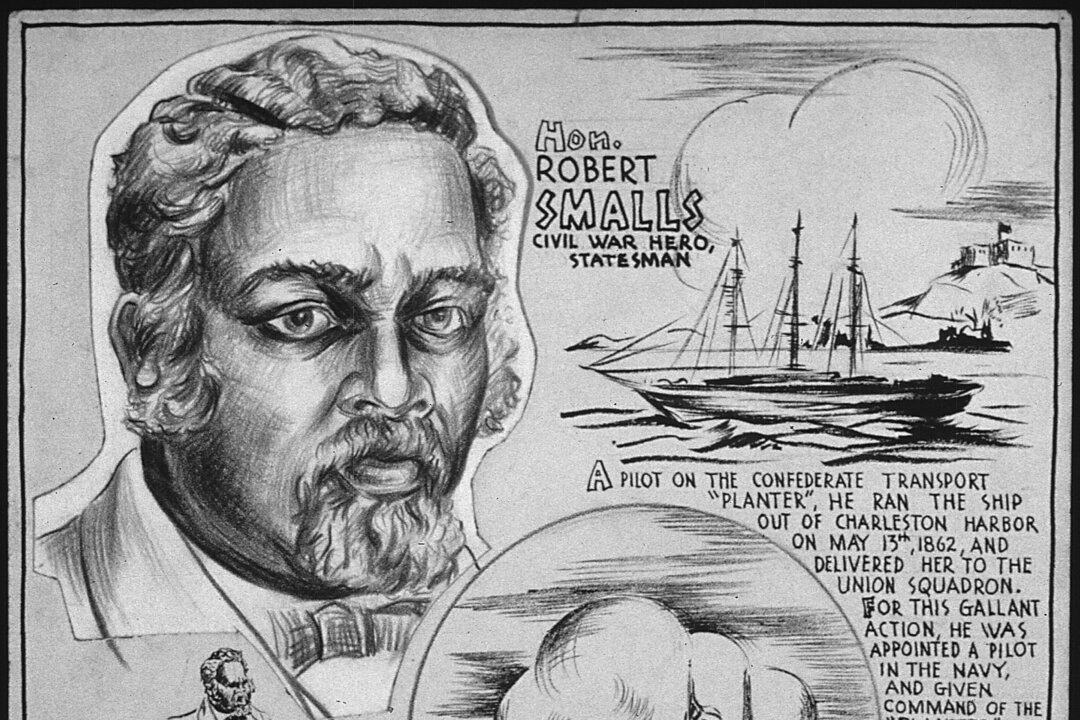

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

How Art Is Helping Veterans With PTSD

Artist Tim Gagnon gives veterans a way to move forward in civilian life.

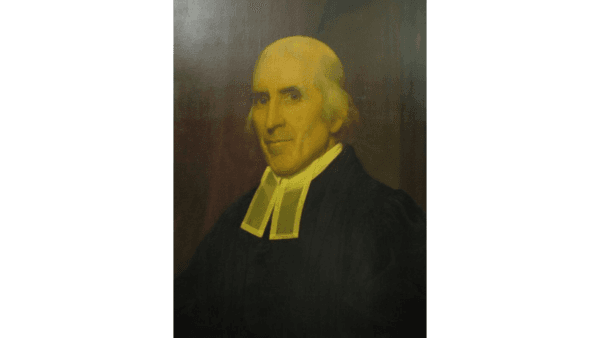

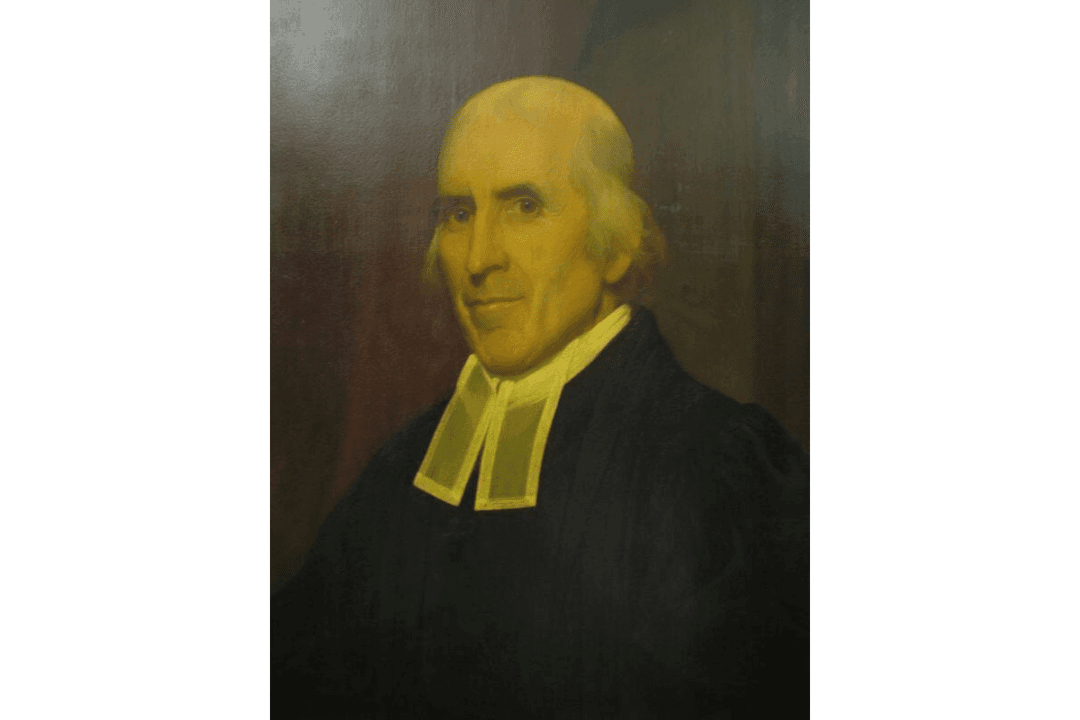

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

How the US–Iraq Relationship Devolved Into War

Decades of animosity swirl in Steve Coll’s ‘The Achilles Trap: Saddam Hussein, the C.I.A., and the Origins of America’s Invasion of Iraq.'

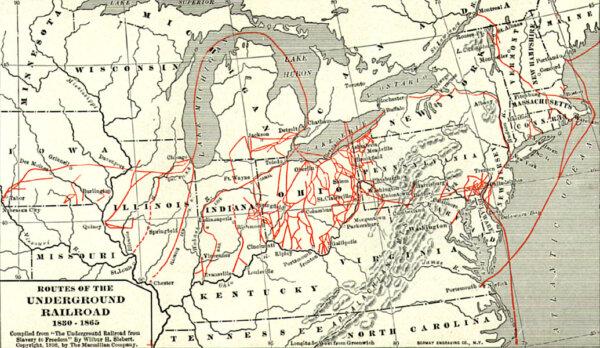

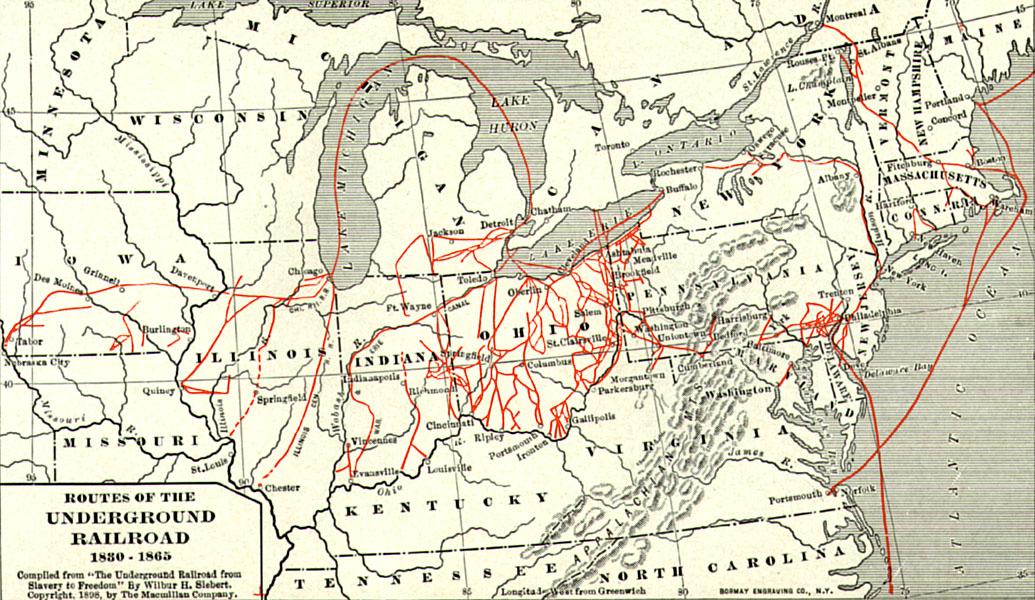

Important Players in a Divided Nation

Sons of the North, including young Spencer Kellogg, gave their all for the fight against slavery during the Civil War.

‘Terrestrial Verses’: Censorship Up Close and Personal

Iranians face absurd suppression of their rights by bureaucrats.

You Need a Kitchen Assistant

Your slow cooker can help you prepare a meal for less that two cents an hour.

Rocky Mountaineer Train Launches Summer Season Promising Spectacular Views

Rocky Mountaineer has four routes that will take passengers through Western Canada and the American Southwest.

After 5 Years of Closure, ‘Glamping’ Back Again in Yosemite National Park

Camping hopefuls can now enter a lottery to experience three of the five available campsites.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

Rocky Mountaineer Train Launches Summer Season Promising Spectacular Views

Rocky Mountaineer has four routes that will take passengers through Western Canada and the American Southwest.

![[PREMIERES 8PM ET] Little-Known 9–0 Supreme Court Ruling Was a Big Win for Property Rights | Facts Matter](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F24%2Fid5636312-03222024-DSC09172-SCOTUSKO-600x400.jpg&w=1200&q=75)