SPECIAL COVERAGE

Read More

Read More

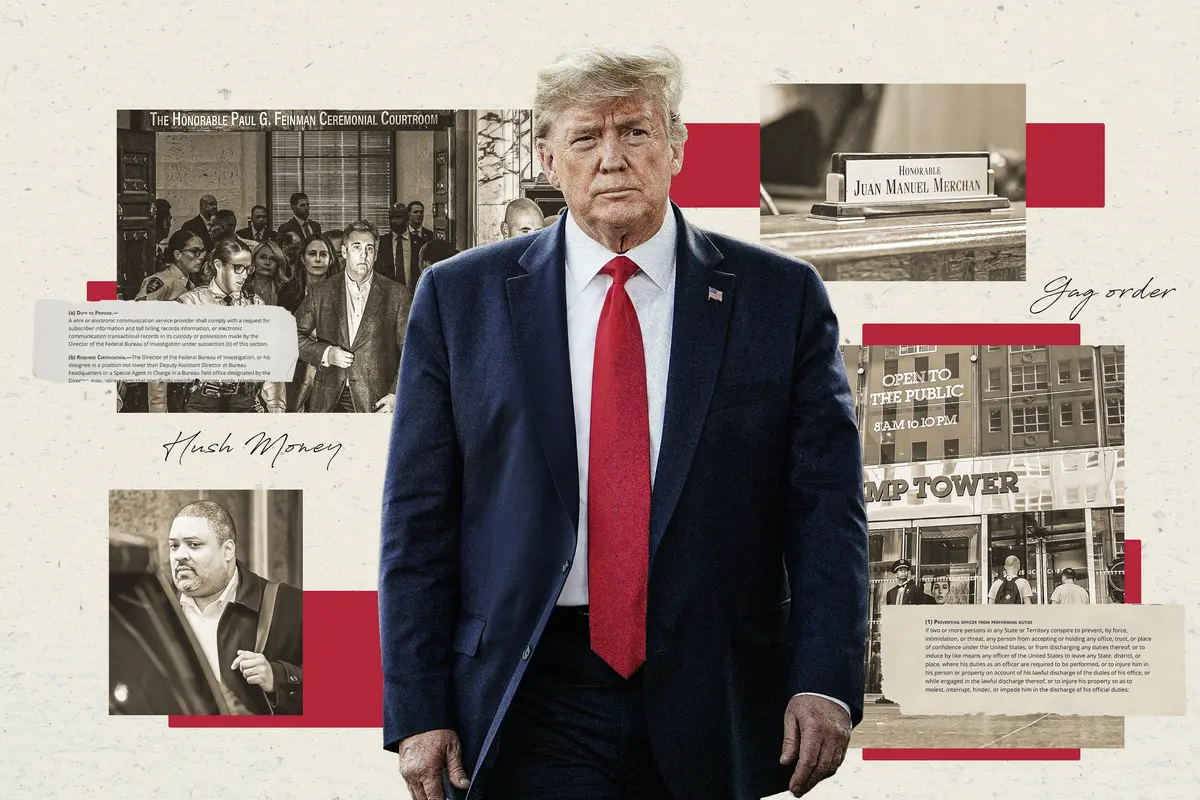

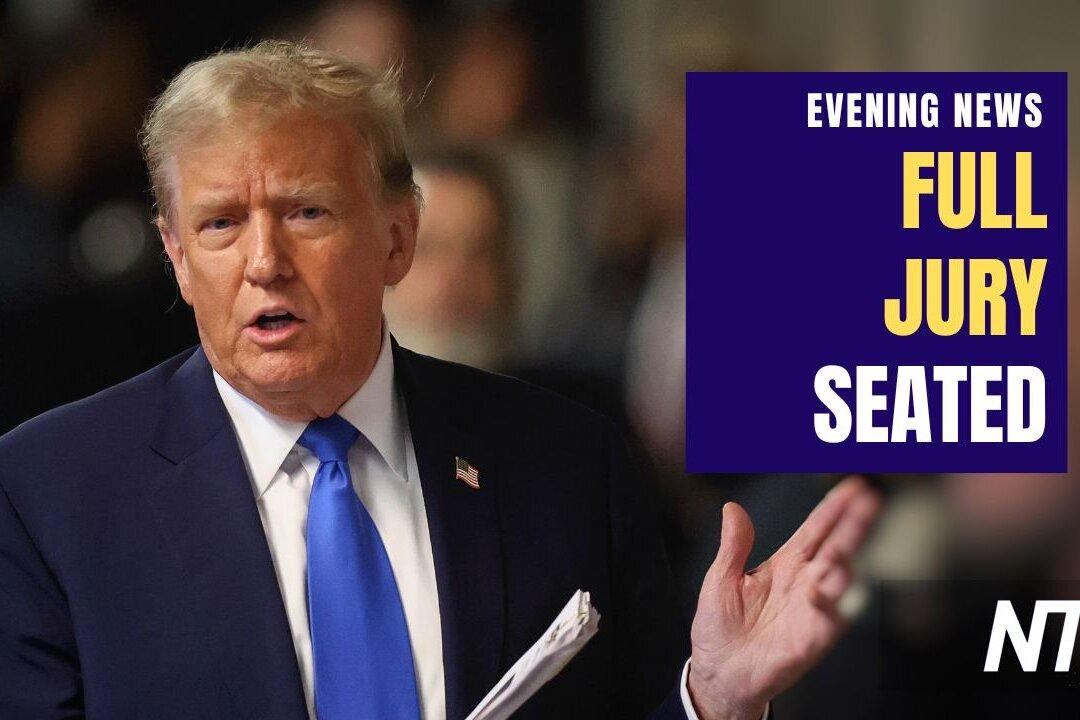

Full Jury Seated for Trump New York Trial

12 jurors—7 men and 5 women—have been seated, and opening arguments are slated for Monday. 5 more alternates will be selected on Friday.

Full Jury Seated for Trump New York Trial

12 jurors—7 men and 5 women—have been seated, and opening arguments are slated for Monday. 5 more alternates will be selected on Friday.

Trending Videos

Top Premium Reads

Top Stories

Most Read

FBI Warns Chinese Hackers Are Poised to Hit US Infrastructure Anytime With ‘Devastating Blow’

‘Its plan is to land low blows against civilian infrastructure to try to induce panic,’ FBI Director Christopher Wray said.

Gaetz Raises Alarm Over Lockheed Martin’s Control of F-35 Fighter Jet Program

As of February 2023, only 29 percent of the United States’ F-35 jets were considered ‘fully mission capable.’

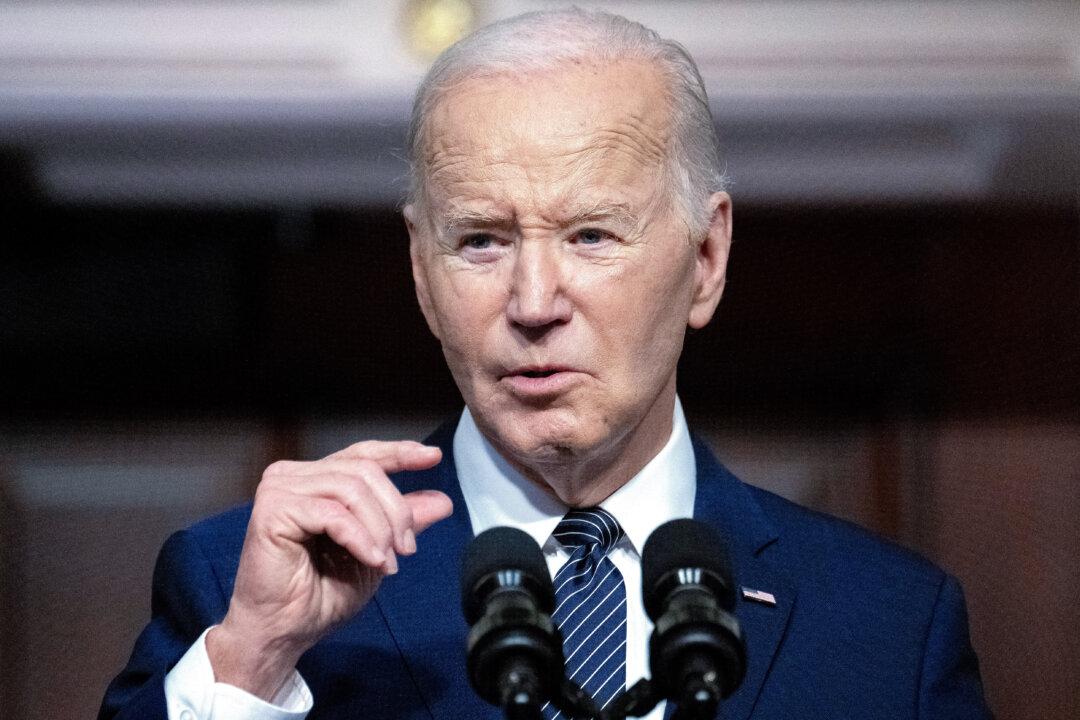

Biden Calls Beijing ‘Xenophobic,’ Says the Regime Is ‘Cheating’ America on Trade

‘They’re xenophobic—nobody else coming in. They’ve got real problems.’

Amid Budget Shortfall, San Francisco Reexamines Tax Burden on Big Businesses

City leaders are negotiating with business execs and labor to craft reforms that would simplify taxes.

Chinese Embassy’s Reported TikTok Lobbying Triggers Bipartisan Outrage

Lawmakers say that the Chinese embassy’s moves show that the CCP considers TikTok a ’strategic asset' for influence operations in America.

Trump New York Trial Makes Headway as Full Jury Seated

Opening statements are scheduled for April 22, and court will adjourn at 2 p.m. to accommodate those who need to leave for Passover.

Johnson Says He Won’t Change Motion to Vacate Rule After Republican Pushback

House Speaker Mike Johnson (R-La.) was openly critical of the motion to vacate but announced that he wouldn’t be pursuing a rule change.

National Security Concerns Raised as Number of Chinese Military-Age Illegal Immigrants Hits Record High

‘Illegal border crossings by Chinese nationals are skyrocketing,’ said Florida Rep. Brian Mast. ‘This is a national security threat.’

Texas Is Enforcing Federal Immigration Laws: Gov. DeSantis

Instead of executing laws to check illegal immigration, the federal government is ‘intentionally violating’ them.

Top Military Official Lied About Jan. 6: Whistleblowers

Army Secretary Ryan McCarthy was among senior officials who did not tell the truth about what happened on Jan. 6, 2021, National Guard officials say.

Study Finds ‘Significant Increase’ in Cancer Mortality After Mass Vaccination With 3rd COVID Dose

Numerous mechanisms may explain how mRNA COVID-19 vaccines may be linked to increased cancer deaths.

Biden Admin Announces New Sanctions Targeting Iran’s Drone Industry After Attack on Israel

‘Today, we are holding Iran accountable—imposing new sanctions and export controls on Iran.’

Senate Overcomes Procedural Hurdle to Reauthorize Spying Authority

The bill, now set for swift passage in the Senate, does not require that intelligence officials have a warrant to search Americans’ data and communications.

The American Mozart: Composer Timothy Olmsted

Timothy Olmsted’s lifelong dedication to music made him one of the country’s earliest influential musicians.

The American Mozart: Composer Timothy Olmsted

Timothy Olmsted’s lifelong dedication to music made him one of the country’s earliest influential musicians.

Epoch Readers’ Stories

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

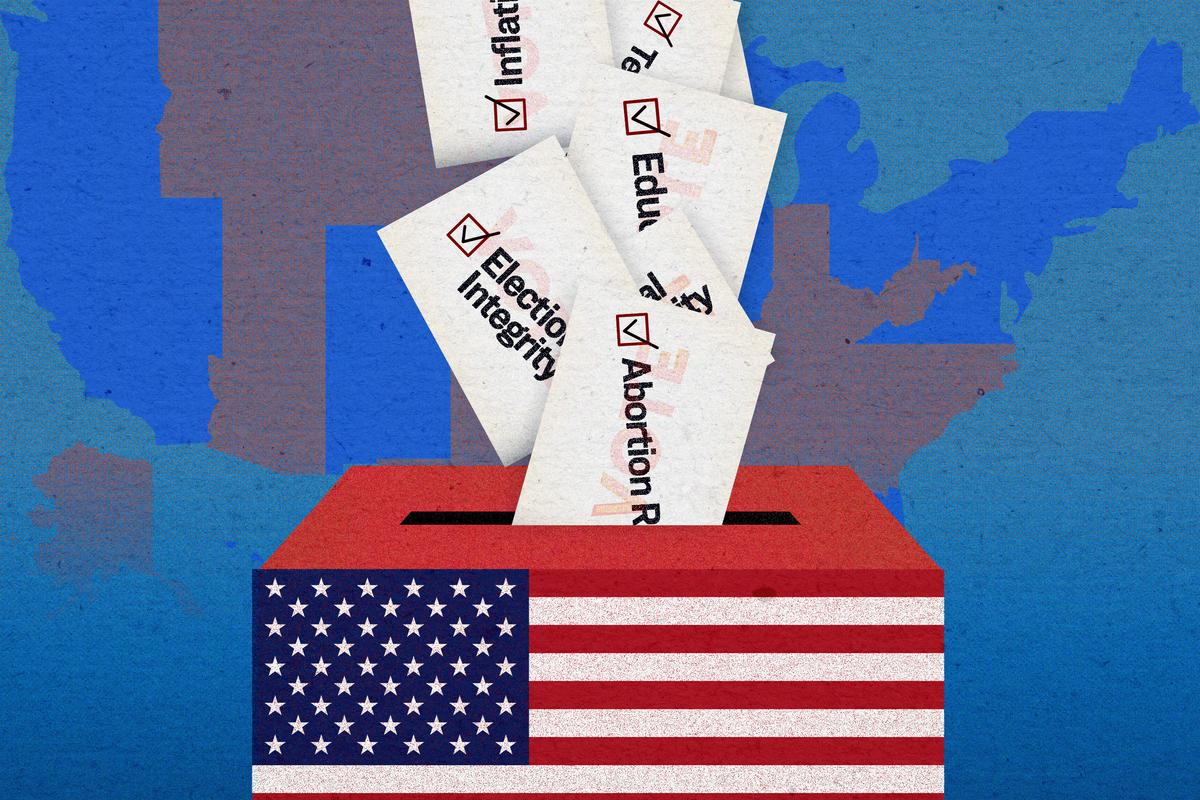

Section 3 of 14th Amendment Not Applicable for Ruling Trump out of 2024

I don’t believe that Section 3 of 14th Amendment is self-executive and therefore can not be applied directly by the court.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

D-Mannose for UTIs: Miracle Supplement or Just Hype?

Nature’s UTI defender faces new scrutiny. Can it stand the test of science?

D-Mannose for UTIs: Miracle Supplement or Just Hype?

Nature’s UTI defender faces new scrutiny. Can it stand the test of science?

‘Hart’s War’: Soldiers Shaping War and Being Shaped by It

A court-martial at the POW camp is not what it seems to be in this film by director Gregory Hoblit.

‘Monsieur Chopin: A Play With Music’

This one-man play celebrates the life and music of one great composer.

S. Truett Cathy: Founder of Chick-fil-A

This entrepreneur called on his ethic of hard work to build a successful fast food franchise.

Rembrandt’s Sole Seascape and the Great Heist

Stolen from the Isabella Stewart Gardner Museum in 1990, ‘Christ in the Storm on the Sea of Galilee’ along with two other Rembrandts are still missing.

Where Time Stands Still: Mast General Store

The general stores encapsulates a bygone era for travelers in North Carolina.

The ‘French 75’ Cocktail Will Make You Feel Like You’re at a Fancy Restaurant

A French 75 is a great classic cocktail to celebrate milestones or special events with.

The Next Total Solar Eclipse Will Hit These 2 Popular World Travel Destinations in 2026

The next total eclipse will fall over Iceland and Spain.

Ed Perkins on Travel: Travel Scams—Anything New?

Hotels are not the only places that have hidden fees.

Helsinki and Tallinn: Pearls of the Baltic

Finland and Estonia—are not only neighbors, but soul sisters.

The Next Total Solar Eclipse Will Hit These 2 Popular World Travel Destinations in 2026

The next total eclipse will fall over Iceland and Spain.

![[LIVE on 4.19 1PM ET] How Diet, Lifestyle Could End 80 Percent of Diabetes, Cancer, Other Disease](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F13%2Fid5628731-Food-Matters-web-1920x1080-1.jpeg&w=1200&q=75)

![[LIVE on 4.19 1PM ET] How Diet, Lifestyle Could End 80 Percent of Diabetes, Cancer, Other Disease](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F13%2Fid5628731-Food-Matters-web-1920x1080-1-1080x720.jpeg&w=1200&q=75)

![[LIVE Q&A 04/19 at 10:30AM ET] Major Case Could Overturn Jan. 6 Charges](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F18%2Fid5632533-CR-TN_REC_0419-600x338.jpg&w=1200&q=75)