SPECIAL COVERAGE

Read More

Read More

Ukraine, Israel Aid Bill Clears Procedural Hurdle in House With Democrat Help

In a move breaking from custom, Democrats stepped in to help advance aid bills for Ukraine, Israel, and Taiwan, and a measure that could ban TikTok.

Ukraine, Israel Aid Bill Clears Procedural Hurdle in House With Democrat Help

In a move breaking from custom, Democrats stepped in to help advance aid bills for Ukraine, Israel, and Taiwan, and a measure that could ban TikTok.

Trending Videos

Top Premium Reads

Top Stories

Most Read

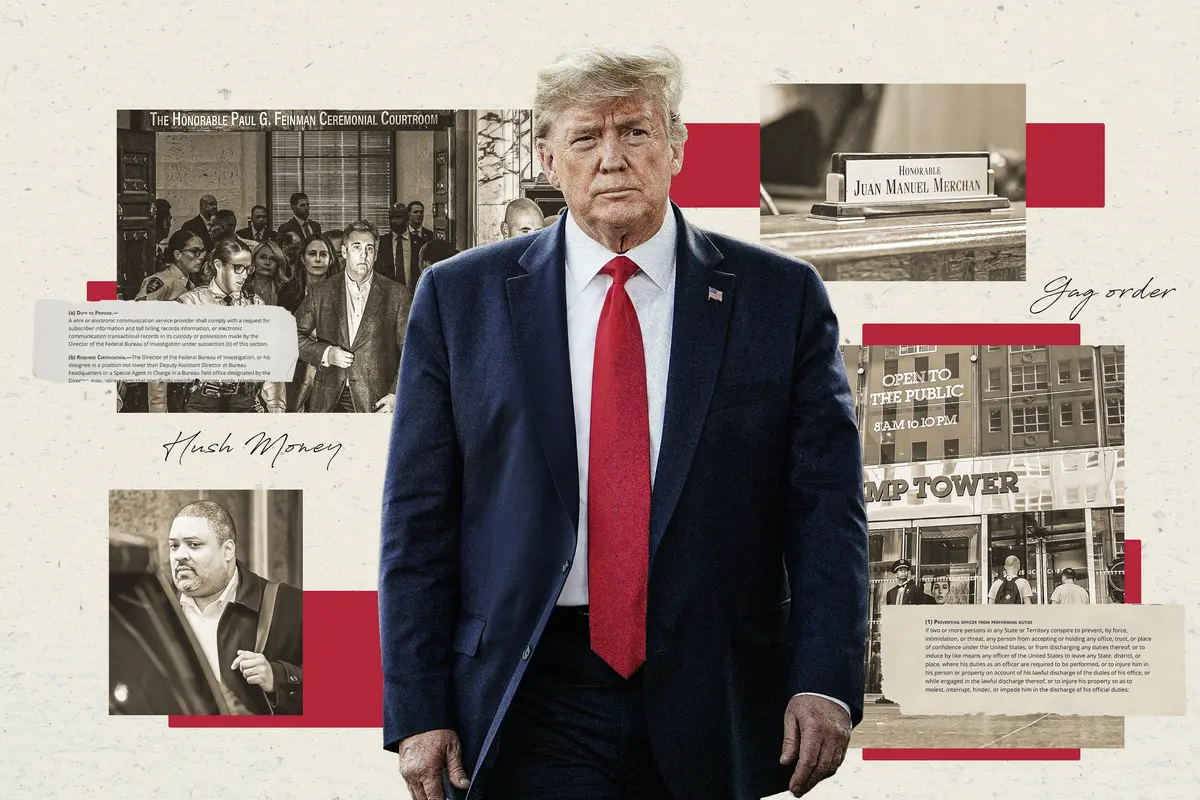

Trump Attorneys Fight to Prevent Past Cases From Being Brought Up in Trial

Trump confirmed he was willing to testify, despite the prosecutor’s push to bring up past cases.

IRS Announces Tax Refund Increase as It Rakes in Near-Record $4.7 Trillion From Taxpayers

Tax refunds boosted by 3 percent.

Prosecutor Says Charges Dropped Against Election Software Company for Political Reasons

A tort claim alleges Los Angeles DA George Gascon dropped the case after being praised by former President Donald Trump.

Senate Scrambles to Reach FISA Deal Before Midnight Deadline

Members are divided over warrantless spying powers that have been used to target U.S. citizens.

Planned Parenthood Abortions Among ‘Top Four Leading Causes of Death’ in America

The organization reduced the number of consultations on health issues, while it focused on providing abortion services.

IRS Sued for Illegally ‘Concealing’ Records on ‘Race-Based Tax Audits’

America First Legal filed the complaint earlier this week.

Man Sets Himself on Fire Outside Trump Trial Courthouse

The act of self-immolation lasted about 45 seconds and ended when police put the flames out with a fire extinguisher.

Biden Admin’s Anti-Sex Discrimination Rule Redefines Sex to Include Gender Identity

The new rule overturns the Trump-era rule on how schools respond to complaints of sexual misconduct.

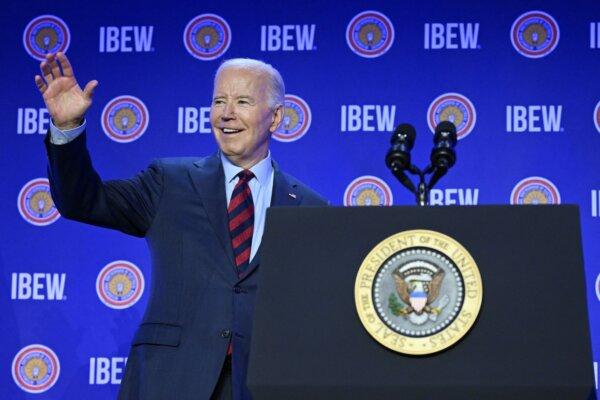

Biden Restricts New Oil and Gas Leasing on 13 Million Acres of Alaskan Land

‘When you take off access to our resources ... this is the energy insecurity that we’re talking about,’ Rep. Lisa Murkowski (R-Alaska) said.

NatCon Cancellation Attempt Shows Rising Threat to Free Speech in Europe

‘Don’t vacate the premises. Make them throw you out,’ ADF International’s Jean-Paul Van De Walle said. ‘Make them show what they’re capable of doing.’

Top Military Official Lied About Jan. 6: Whistleblowers

Army Secretary Ryan McCarthy was among senior officials who did not tell the truth about what happened on Jan. 6, 2021, National Guard officials say.

RNC Seeks to Deploy 100,000 Election Integrity Workers Ahead of 2024 Elections

The Republican National Committee said it will recruit a small army of volunteers and attorneys to step up its election integrity efforts in 2024.

Over 100 People Arrested During Pro-Palestinian Protest at Columbia University

The arrests were made after the Columbia University’s president authorized the New York Police Department to clear an encampment set up by protesters on campus.

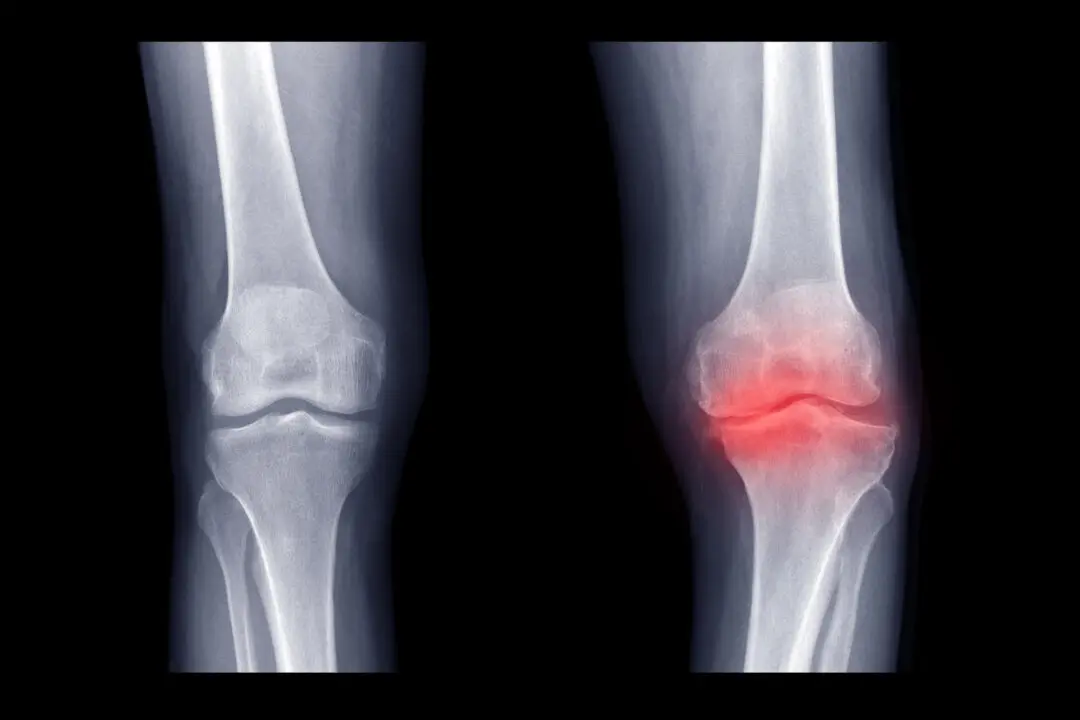

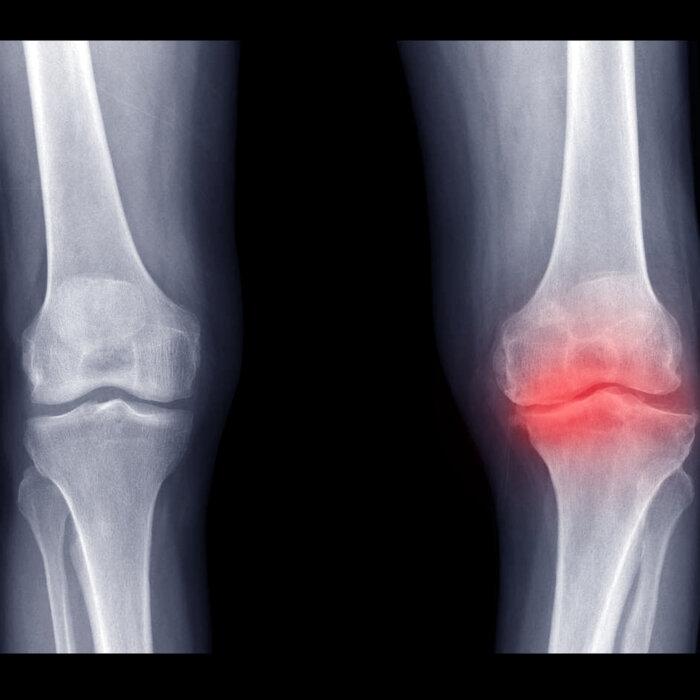

Pulsed Electromagnetic Field Therapy May Relieve Osteoarthritis: Study

Pulsed electromagnetic field (PEMF) therapy shows promise in reducing pain and improving quality of life for osteoarthritis patients.

Celebrating the World’s Best Portrait and Figurative Artworks

The Portrait Society of America selected its International Portrait Competition finalists.

Celebrating the World’s Best Portrait and Figurative Artworks

The Portrait Society of America selected its International Portrait Competition finalists.

Epoch Readers’ Stories

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Section 3 of 14th Amendment Not Applicable for Ruling Trump out of 2024

I don’t believe that Section 3 of 14th Amendment is self-executive and therefore can not be applied directly by the court.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Parkinson’s Dulls Physical Response to Emotions: Study

A new study has suggested that anger, disgust, and even sadness hit with less force for those who have the neurodegenerative disorder.

Parkinson’s Dulls Physical Response to Emotions: Study

A new study has suggested that anger, disgust, and even sadness hit with less force for those who have the neurodegenerative disorder.

The Surprising Roots of Indoctrination by Colleges

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

‘God Bless the U.S.A.’

Lee Greenwood’s surprise single release became a classic American anthem and a unifying symbol of patriotism.

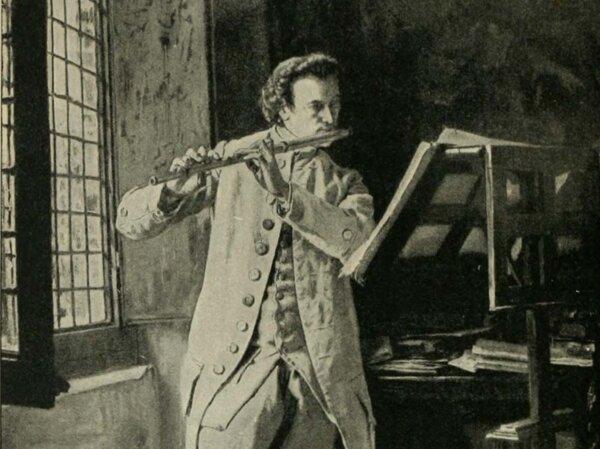

The American Mozart: Composer Timothy Olmsted

Timothy Olmsted’s lifelong dedication to music made him one of the country’s earliest influential musicians.

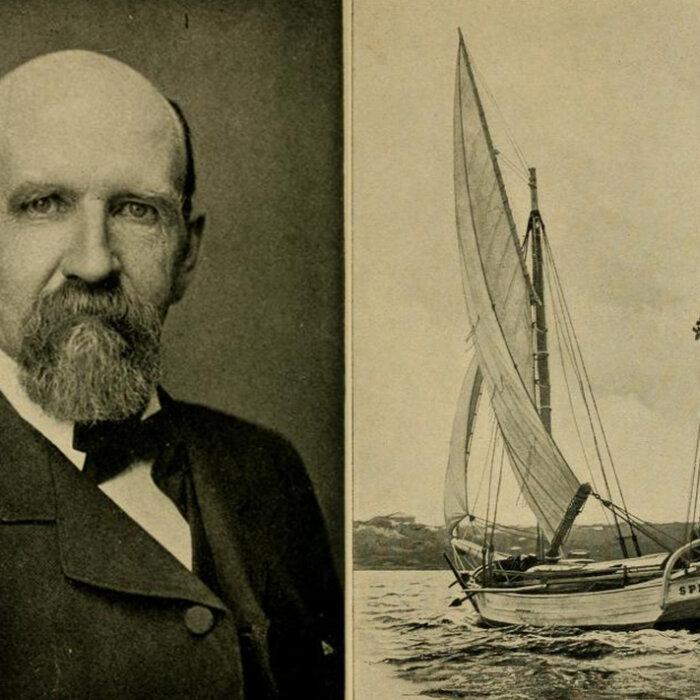

S. Truett Cathy: Founder of Chick-fil-A

This entrepreneur called on his ethic of hard work to build a successful fast food franchise.

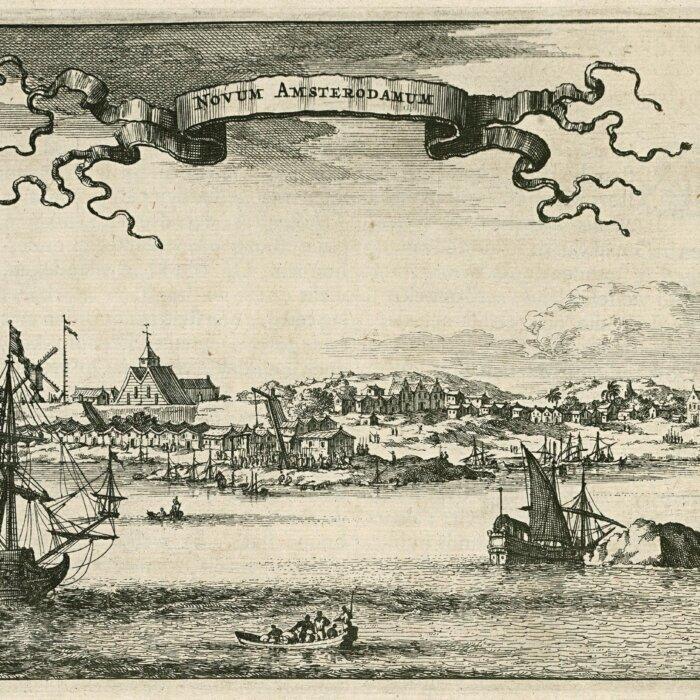

Rembrandt’s Sole Seascape and the Great Heist

Stolen from the Isabella Stewart Gardner Museum in 1990, ‘Christ in the Storm on the Sea of Galilee’ along with two other Rembrandts are still missing.

The Surprising Roots of Indoctrination by Colleges

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

Chicken Shawarma in a Bowl Is a Tasty, Healthy Meal

Roasting the chicken legs while the grain is cooking will help this dish come together quicker.

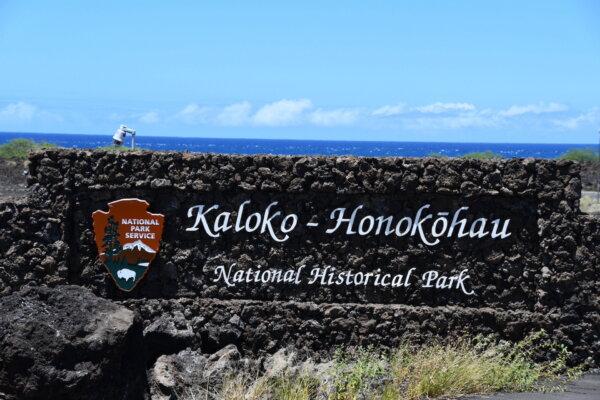

Taking the Kids: And Heading to Less Visited National Parks

There are 429 national park sites in the U.S., though just 63 have the “National Park” designation in their names.

Thailand Leads Push for Six-Nation Visa to Lure Moneyed Tourists

The plan is so that tourists can travel six countries on one visa, but some officials are not optimistic.

Brazil Postpones Visa Requirements Once Again for American Visitors

The goal is to ensure that Brazil’s electronic visa program is fully up and running before applying the visa requirement.

Taking the Kids: And Heading to Less Visited National Parks

There are 429 national park sites in the U.S., though just 63 have the “National Park” designation in their names.

![[LIVE 4/26 at 10:30AM ET] New Push Started for Global Digital Currencies](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F19%2Fid5633115-0426-600x338.jpg&w=1200&q=75)