SPECIAL COVERAGE

Read More

Read More

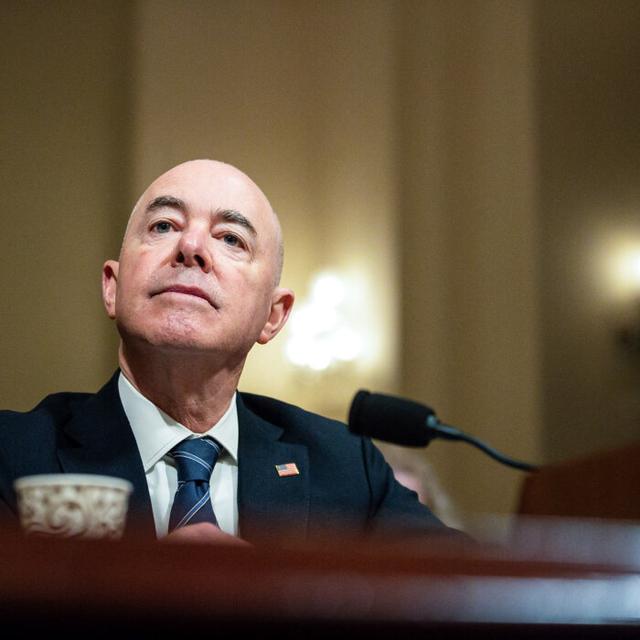

Israel Reportedly Strikes Iran Overnight, Tehran Downplays the Attack

Secretary Blinken declined to acknowledge the latest attacks on Iran, stating that the United States was not involved.

Israel Reportedly Strikes Iran Overnight, Tehran Downplays the Attack

Secretary Blinken declined to acknowledge the latest attacks on Iran, stating that the United States was not involved.

Trending Videos

Top Premium Reads

Top Stories

Most Read

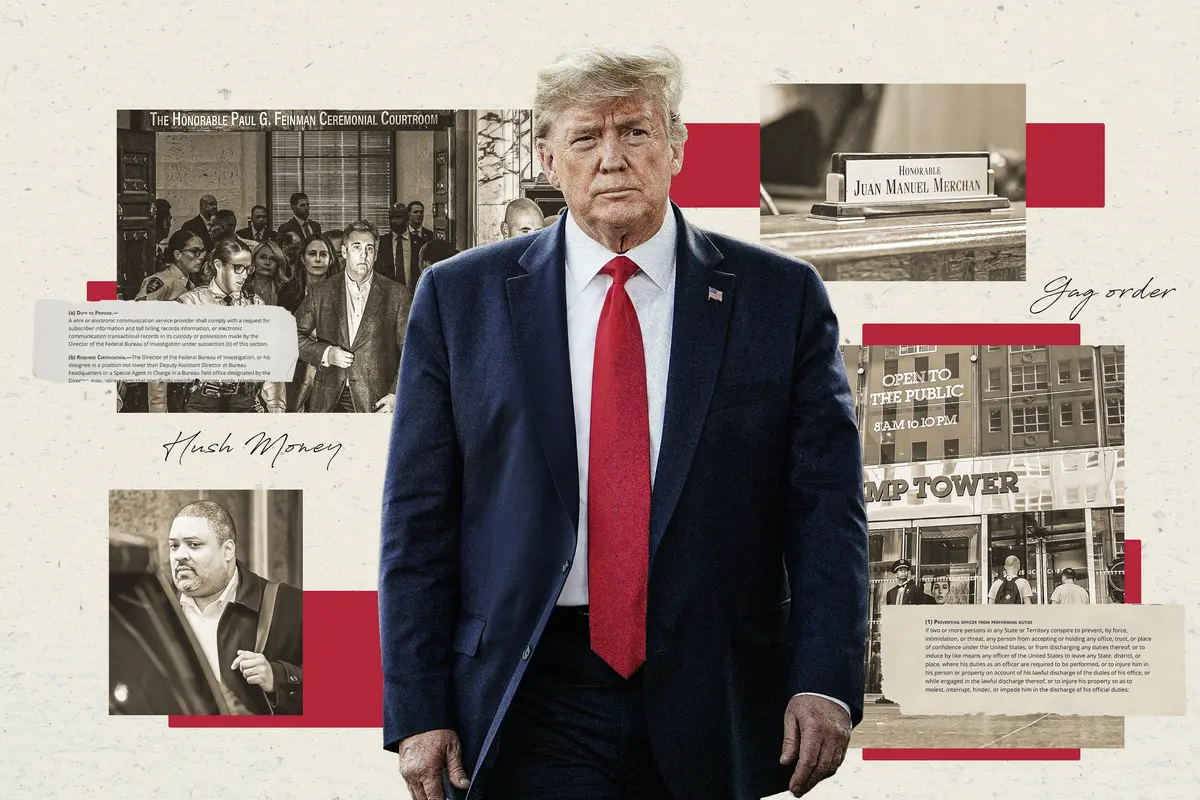

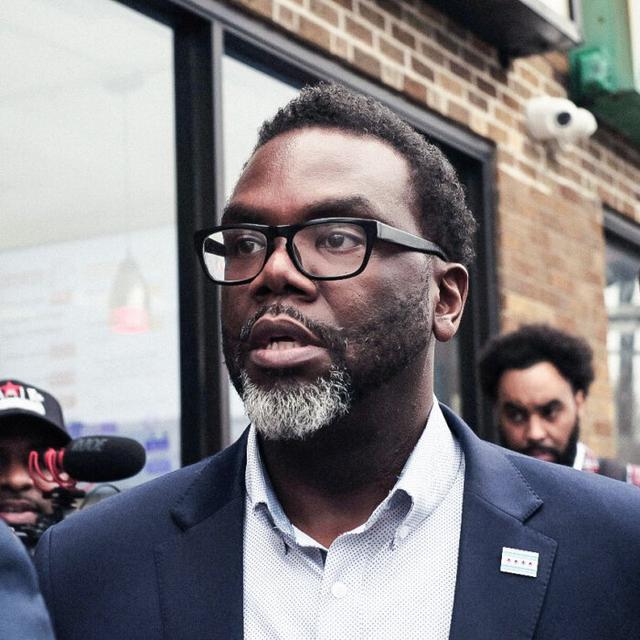

Trump Blames Case on Politics as He Arrives for Trial

Manhattan District Attorney Alvin Bragg has charged the former president with 34 counts of falsifying business records.

House Advances $95 Billion Foreign Aid Package With Democrat Help

In a rare move, Democrats helped advance the bills for Ukraine, Israel, and Taiwan on the House floor.

Over 100 People Arrested During Pro-Palestinian Protest at Columbia University

The arrests were made after the Columbia University’s president authorized the New York Police Department to clear an encampment set up by protesters on campus.

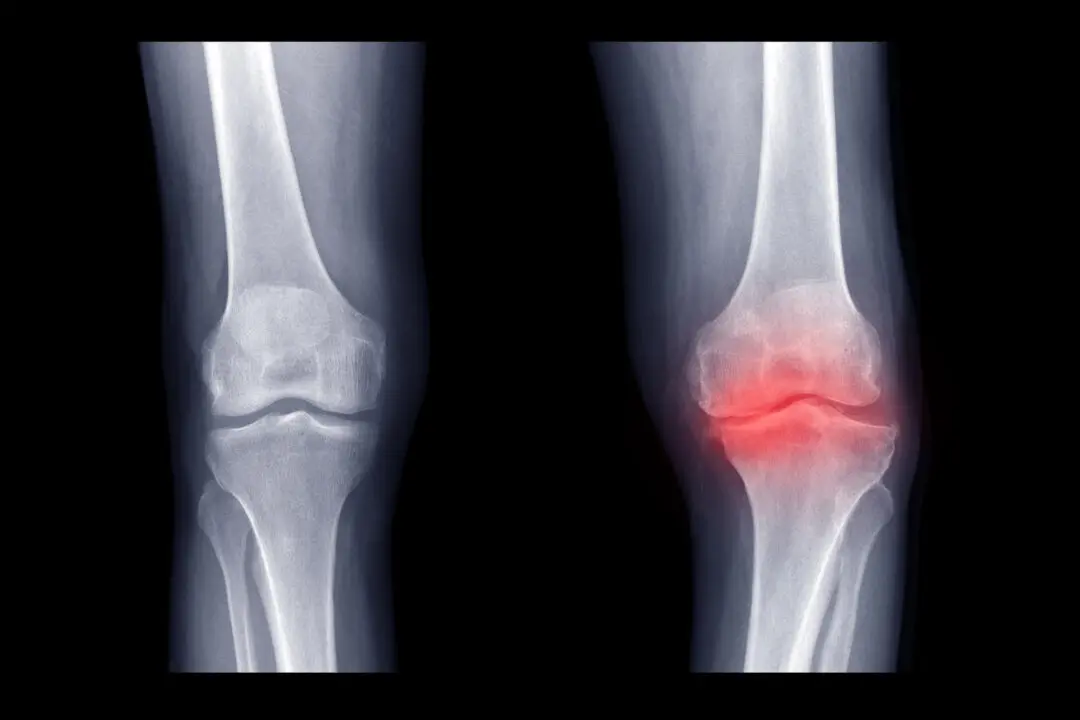

Pulsed Electromagnetic Field Therapy May Relieve Osteoarthritis: Study

Pulsed electromagnetic field (PEMF) therapy shows promise in reducing pain and improving quality of life for osteoarthritis patients.

Charter School Founders Accused of Massive Fraud

Preliminary hearings have begun in case based in part on an investigative audit claiming trio pocketed millions in public education funds.

Non-Dairy Milk Options Amid Concerns of Bird Flu in Dairy Cattle

An abundance of non-dairy milk choices offer options for those looking for healthy alternatives to cow’s milk.

Elections Modeler Changes Arizona Senate, Key House Race Ratings to ‘Leans Democrat’

Forecaster says court ruling and ballot measure aids Democrats in battleground state’s Senate and House races, but notes no change in Trump-Biden ‘Toss-Up.’

Vitamin A: 13 Foods for Supplementing the Vision Vitamin

This fat-soluble vitamin helps keep your eyes healthy, supports immunity, fights free radicals, and is critical for fetal development.

Risk of Bird Flu Spreading to Humans Is Great Concern: World Health Organization

H5N1 avian flu has recently infected cows and goats in the United States.

In Unusual Move, Democrats Help Republicans Advance Foreign Aid Package to House Floor

Democrats on the GOP-led House Rules Committee stepped in to advance bills for Ukraine, Israel to the floor to overcome 3 conservatives who voted against it.

Top Military Official Lied About Jan. 6: Whistleblowers

Army Secretary Ryan McCarthy was among senior officials who did not tell the truth about what happened on Jan. 6, 2021, National Guard officials say.

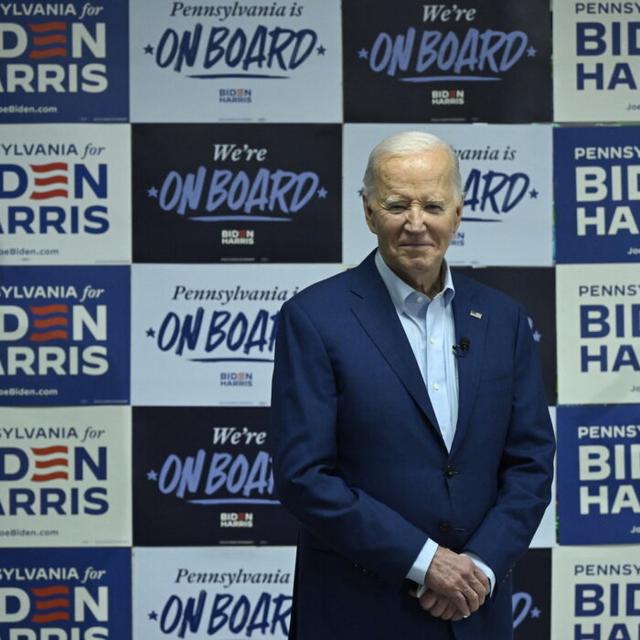

Biden’s Bid to Appear on Ohio Ballot in Limbo as Officials Reject Democrat Plan

‘No alternative process is permitted,’ said Ohio Attorney General Dave Yost.

Proposal to Reform California’s Prop. 47 Gets Enough Signatures to Appear on Ballot

Supporters collected more than 900,000 signatures to place the tough-on-crime measure on the November ballot.

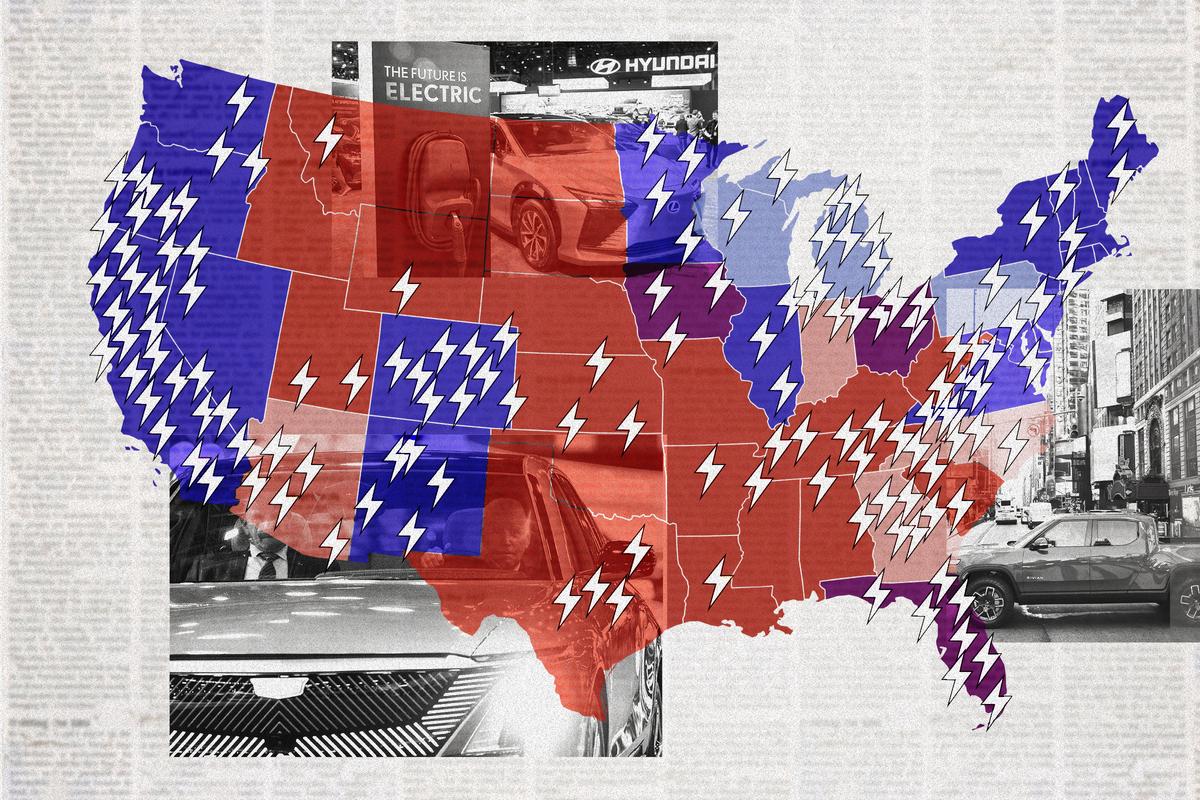

Congressman Introduces Bill to Stop Cobalt Mined by Child Exploitation and Forced Labor From Entering US Market

Cobalt is a key natural resource used to power electric vehicles, solar panels, and other purportedly “green” products. Around 90 percent of it originates from

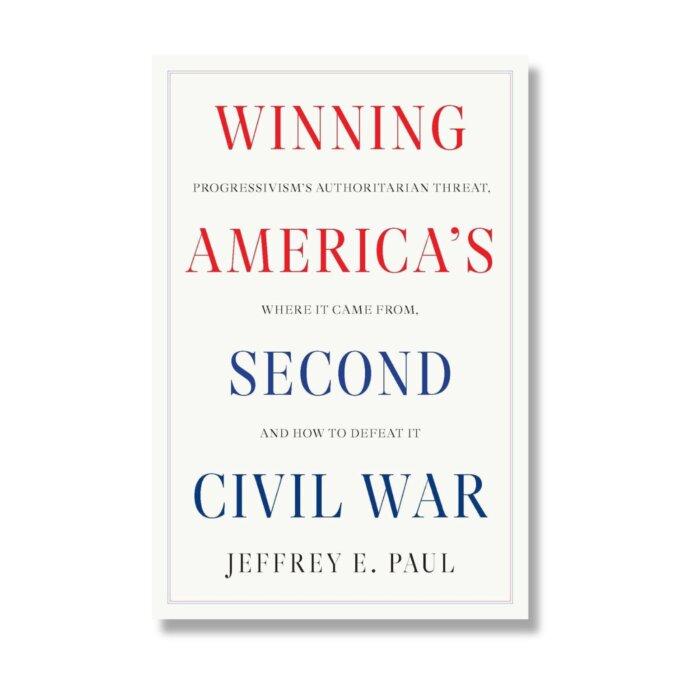

The Surprising Roots of College Indoctrination

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

The Surprising Roots of College Indoctrination

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

Epoch Readers’ Stories

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Section 3 of 14th Amendment Not Applicable for Ruling Trump out of 2024

I don’t believe that Section 3 of 14th Amendment is self-executive and therefore can not be applied directly by the court.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

‘God Bless the U.S.A.’

Lee Greenwood’s surprise single release became a classic American anthem and a unifying symbol of patriotism.

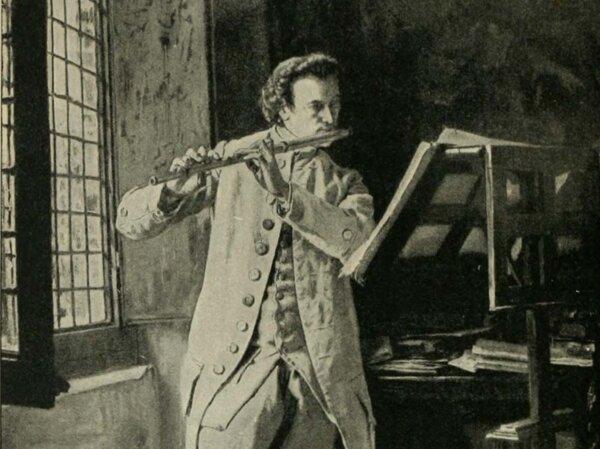

The American Mozart: Composer Timothy Olmsted

Timothy Olmsted’s lifelong dedication to music made him one of the country’s earliest influential musicians.

S. Truett Cathy: Founder of Chick-fil-A

This entrepreneur called on his ethic of hard work to build a successful fast food franchise.

Rembrandt’s Sole Seascape and the Great Heist

Stolen from the Isabella Stewart Gardner Museum in 1990, ‘Christ in the Storm on the Sea of Galilee’ along with two other Rembrandts are still missing.

Chicken Shawarma in a Bowl Is a Tasty, Healthy Meal

Roasting the chicken legs while the grain is cooking will help this dish come together quicker.

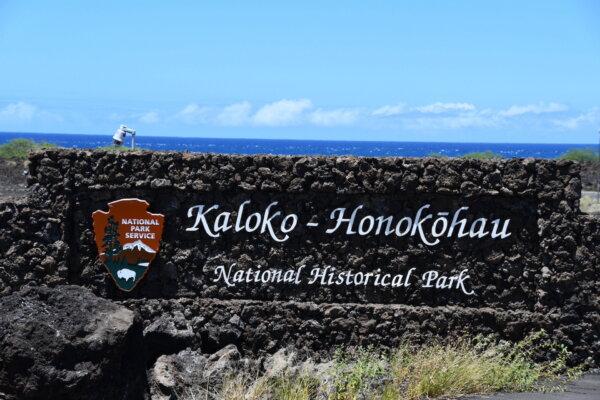

Taking the Kids: And Heading to Less Visited National Parks

There are 429 national park sites in the U.S., though just 63 have the “National Park” designation in their names.

Thailand Leads Push for Six-Nation Visa to Lure Moneyed Tourists

The plan is so that tourists can travel six countries on one visa, but some officials are not optimistic.

Brazil Postpones Visa Requirements Once Again for American Visitors

The goal is to ensure that Brazil’s electronic visa program is fully up and running before applying the visa requirement.

Taking the Kids: And Heading to Less Visited National Parks

There are 429 national park sites in the U.S., though just 63 have the “National Park” designation in their names.

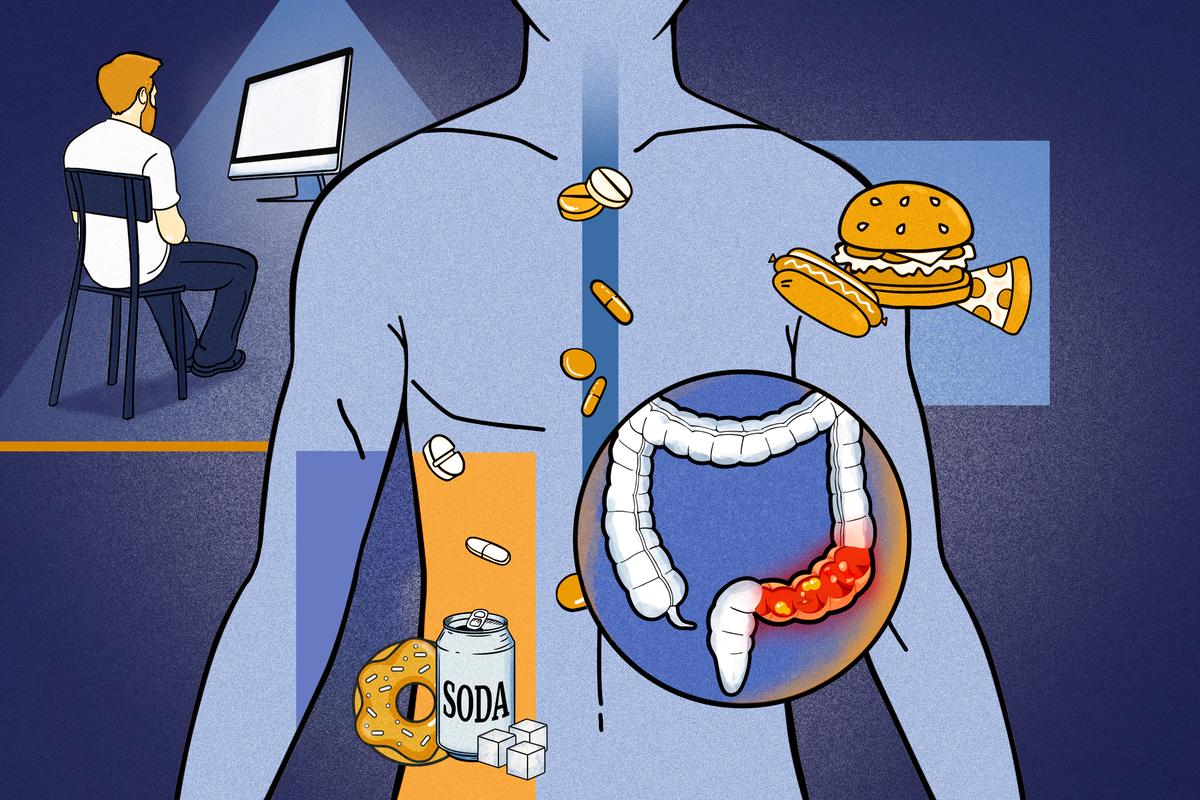

![[LIVE at 1PM ET] How Diet, Lifestyle Could End 80 Percent of Diabetes, Cancer, Other Disease](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F13%2Fid5628731-Food-Matters-web-1920x1080-1.jpeg&w=1200&q=75)

![[LIVE at 1PM ET] How Diet, Lifestyle Could End 80 Percent of Diabetes, Cancer, Other Disease](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F13%2Fid5628731-Food-Matters-web-1920x1080-1-1080x720.jpeg&w=1200&q=75)