SPECIAL COVERAGE

Read More

Read More

Senate to Take Up House-Passed $95 Billion Foreign Aid Package

The package worsened divisions within the House GOP that could soon spark another speakership stalemate.

Senate to Take Up House-Passed $95 Billion Foreign Aid Package

The package worsened divisions within the House GOP that could soon spark another speakership stalemate.

Top Premium Reads

Top Stories

Most Read

COVID-19 Vaccine Protection Among Children Plummets Within Months: CDC Study

Agency says results show why it recommends kids get an updated shot.

Pennsylvania Primary Offers Window Into General Election

Interest in local and congressional races may bring out voters.

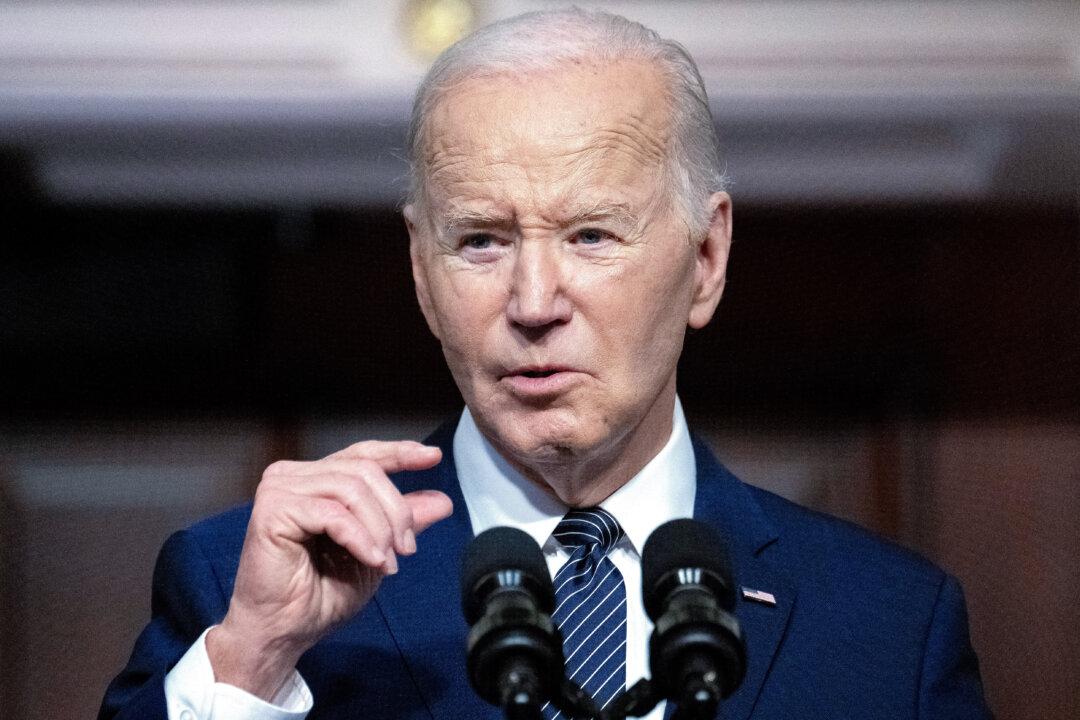

The 20-Year Debate Among 4 US Presidents: Embryonic Stem Cell Cloning

Advanced cloning technologies related to human embryo stem cells has triggered decades of serious debate among Presidents Bush, Obama, Trump, and Biden.

Dershowitz Says New York Prosecutors Are Violating Voters’ Rights With Trump Trial

The law is being ‘abused for partisan political purposes and to constitute election interference,’ Mr. Dershowitz alleged.

Retiring Senator Joe Manchin Endorses Glenn Elliott as Potential Successor

In the Democratic primaries, Mr. Elliott will face opponents Zach Shrewsbury, a Marine Corps veteran, and Don Blankenship, and former coal executive.

Pro-Palestinian Protests in US Campuses Sparks Safety Concerns

After 100 protesters were arrested at Columbia University last, protests have spread to other colleges across the country.

Thousands Gather at California’s Capitol for the 4th Annual March for Life Rally

‘There’s a really big pro-life movement here in California,’ a participant said. ‘And just because the state is overtly blue doesn’t mean that we aren’t here.’

US Report Highlights Covert Chinese Operations to Silence, Punish Critics Abroad

The tactic, known as transnational repression, received worldwide attention after a network of extralegal Chinese police stations was exposed.

Lawmakers Condemn Anti-Semitism at Columbia University Amid Ongoing Protests

A number of lawmakers have denounced discrimination against Jewish students at Columbia University due to an ongoing anti-Israel solidarity assembly on campus.

Trump Jury Selection Offers Clues to New York Trial’s Direction

President Trump’s jury selection has raised questions about the legal process and whether lawyers can serve as suitable jurors.

IMF Issues Grave Warning to Biden Admin On Out-of-Control Deficit Spending

‘Something will have to give,’ the IMF warned of high deficit spending and the risk that it could spiral further out of control in an election year.

Federal Judge Appears Ready to Reimpose Jan. 6 ‘Disinformation’ Monitoring

Senior US District Judge Reggie Walton ordered probationer Daniel Goodwyn to ’show cause' for why he should not reimpose the ill-fated computer monitoring.

Supreme Court Seems Sympathetic to City Trying to Ban Homeless Camps

Grants Pass, Oregon, says a lower court ruling has made it helpless to combat a growing problem.

How to Make Your Own All-Natural, Skin-Nourishing Soap

Meg Hollar, founder of all-natural skincare company Bumblewood and co-host of The Hollar Homestead YouTube channel, shares a beginner-friendly recipe.

How to Make Your Own All-Natural, Skin-Nourishing Soap

Meg Hollar, founder of all-natural skincare company Bumblewood and co-host of The Hollar Homestead YouTube channel, shares a beginner-friendly recipe.

Epoch Readers’ Stories

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Urban Adventures: Paddling in the City

You don’t need a remote mountain lake to enjoy the serenity of kayaking or paddle-boarding.

Special Coverage

Special Coverage

Vizcaya: A Classical Home a Stone’s Throw From Miami

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we see a home inspired by classic Italy in southern Florida.

‘Why Does This Lady Have a Fly on Her Head?’: This 15th-Century Painting Will Leave You Scratching Your Head

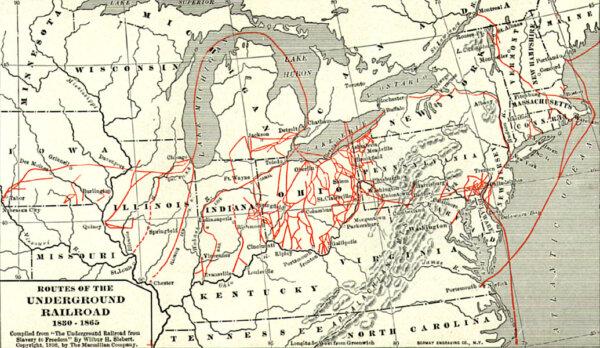

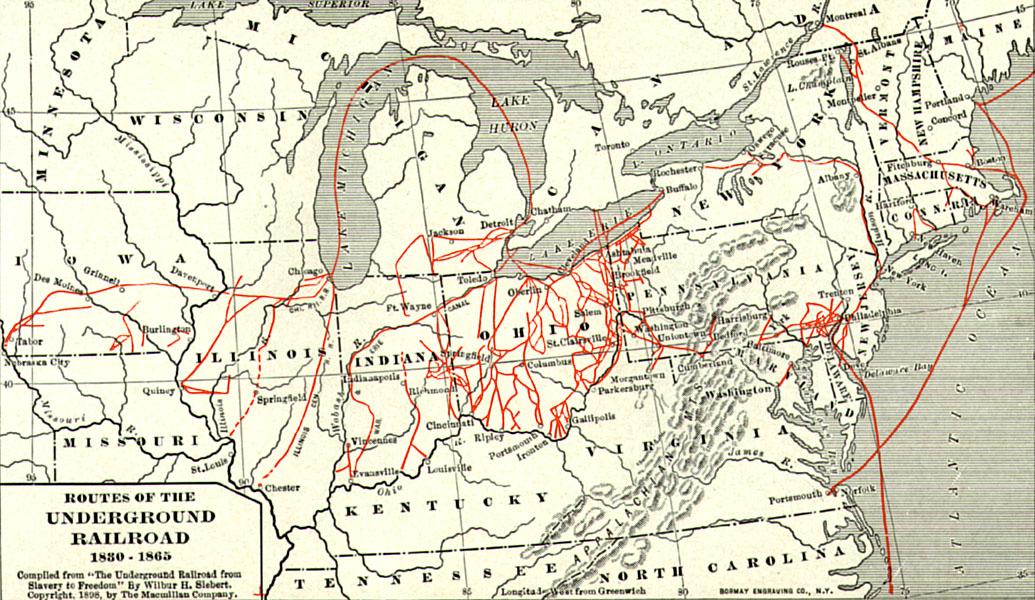

Important Players in a Divided Nation

Sons of the North, including young Spencer Kellogg, gave their all for the fight against slavery during the Civil War.

‘Secrets of the Octopus’: Intelligent and Inviting

This series examines the behavior of one of nature’s most mysterious species.

How a Minister’s Concern Birthed Our National Motto

In ‘This Week in History,’ US Treasurer Salmon Chase approved of an idea, early in the Civil War, that changed the history of American currency.

The Surprising Roots of Indoctrination by Colleges

A West Virginia University professor names names and pinpoints how college indoctrination began, in ‘Winning America’s Second Civil War.’

‘God Bless the U.S.A.’

Lee Greenwood’s surprise single release became a classic American anthem and a unifying symbol of patriotism.

Vizcaya: A Classical Home a Stone’s Throw From Miami

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we see a home inspired by classic Italy in southern Florida.

Alcohol and Acid

The acidity of the wine determines how well it will pair with food but labels often say nothing of acid levels.

Rick Steves’ Europe: Glimpse the Ancient Past in Northeast England

Romans built Hadrian’s wall 2,000 years ago to mark the northern border of their empire.

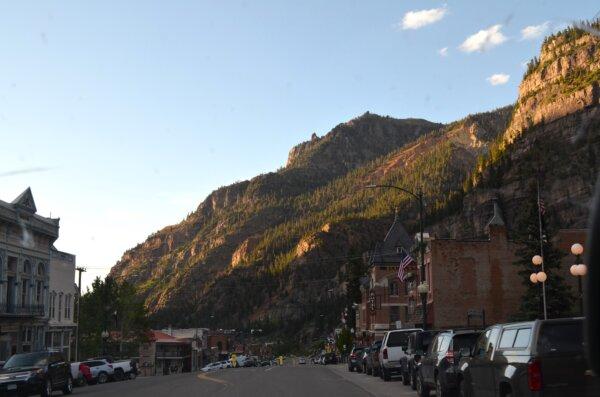

A Weekend Guide in Ouray, Colorado, a Top Vacation Destination for 2024

Ouray is known as the Switzerland of America.

![[PREMIERING 4/23, 9PM ET] How Communist China Weaponized Interpol to Hunt Down Dissidents: Dolkun Isa](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635409-240421-ATL_Dolkun-Isa_HD_TN-600x338.jpeg&w=1200&q=75)

![[LIVE NOW] Pro-Palestinian Protesters Declare ‘Autonomous Zones’](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F22%2Fid5634975-CR-TN_REC_0423-600x338.jpg&w=1200&q=75)