SPECIAL COVERAGE

Read More

Read More

Senate Passes $95 Billion Foreign Aid Package, Sending It to Biden

The package also includes a measure that would force TikTok to divest from its Chinese parent company over national security concerns.

Senate Passes $95 Billion Foreign Aid Package, Sending It to Biden

The package also includes a measure that would force TikTok to divest from its Chinese parent company over national security concerns.

Top Premium Reads

Top Stories

Most Read

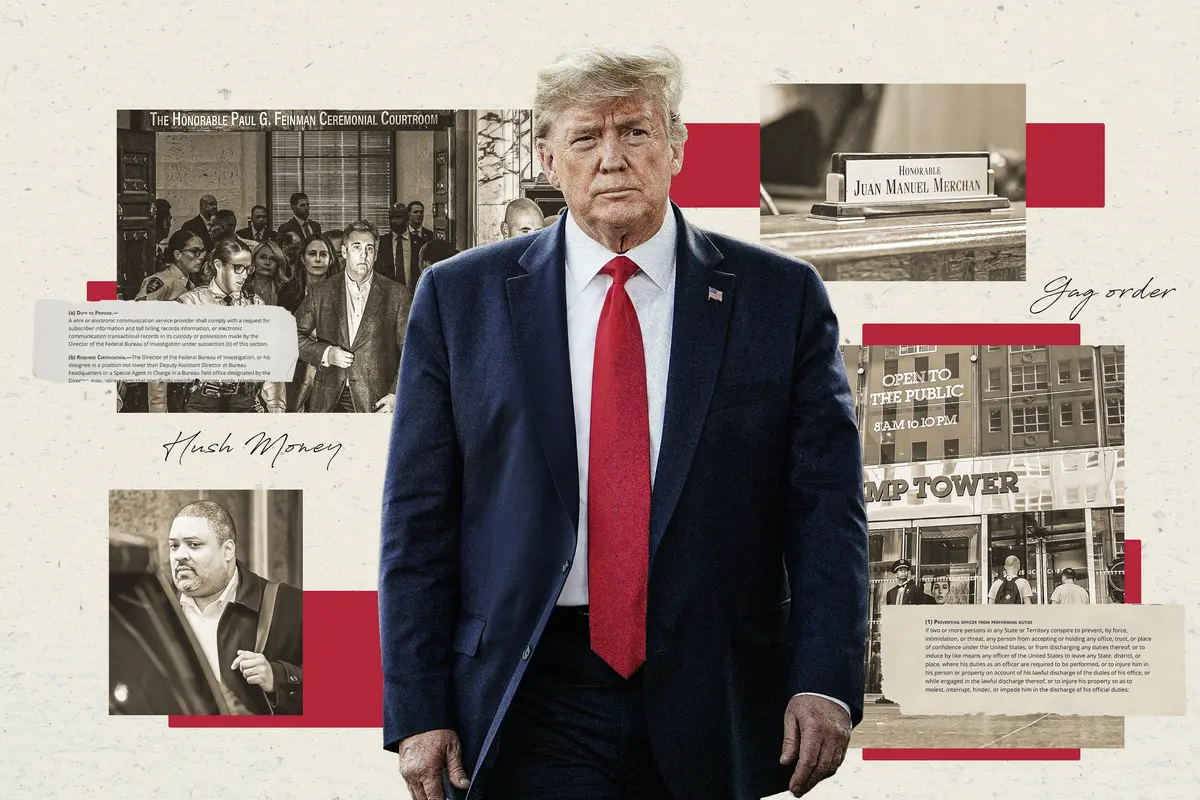

Testimonies Continue in Trump Trial With Ex-publisher David Pecker on the Stand

Prosecutors allege 10 violations.

Bird Flu Found in Pasteurized Milk From Grocery Stores: FDA

‘To date, we have seen nothing that would change our assessment that the commercial milk supply is safe,’ the FDA said.

Bird Flu Found in Commercial Milk: FDA

The Food and Drug Administration said that the commercial milk supply is still safe due to the pasteurization process.

Indiana Republicans Spar in Last Gubernatorial Debate Before Primary

Candidates took jabs at each other and frontrunner Sen. Mike Braun while vying to present themselves as an outsider candidate and true conservative.

Tennessee Lawmakers Pass Bill Allowing School Staff to Carry Concealed Handguns

Republicans say that the bill would enhance security measures in schools.

Senate Passes Bill That Could Ban TikTok

Sen. Mark Warner, chair of the Select Intelligence Committee, highlighted the concern that TikTok was ‘operating at the direction of a foreign adversary.’

Biden Admin Bans Non-Compete Agreements Amid Opposition From Business Groups

The two Republican FTC Commissioners on the panel voted against the rule, which faced opposition from a number of congressional Republicans and business groups.

Biden ‘Regulatory Smurfing’ Mires Oil, Gas Industry in Red Tape, Industry Leaders Say

Field hearing before all-Texas assembly of congressional Republicans criticizes administration’s ‘whole-of-government attack’ in forced green energy transition.

Biden Admin Agrees to Pay $139 Million to Victims for FBI Failures in Sex Abuse Investigation

‘The unfortunate reality is that what we are seeing today is something that most survivors never see,’ said Rachael Denhollander, one of his victims.

Judge Approves Trump’s $175 Million Bond With New Restrictions in New York Civil Case

An agreement was reached between President Trump’s attorney and New York Attorney General Letitia James on the handling of the bond account.

US Drops Out of Top 20 Happiest Countries in New Report

This year’s World Happiness Report focuses on happiness at various ages and stages through life—with some surprising results.

Tesla Laying Off Over 2,000 Employees in Texas Amid Global Workforce Slash

Tesla owner Elon Musk says the layoffs ‘will enable us to be lean, innovative, and hungry for the next growth phase.’

Judge Won’t Rule Immediately on Whether Trump Violated Gag Order

The former president offered sharp criticism of Judge Juan Merchan.

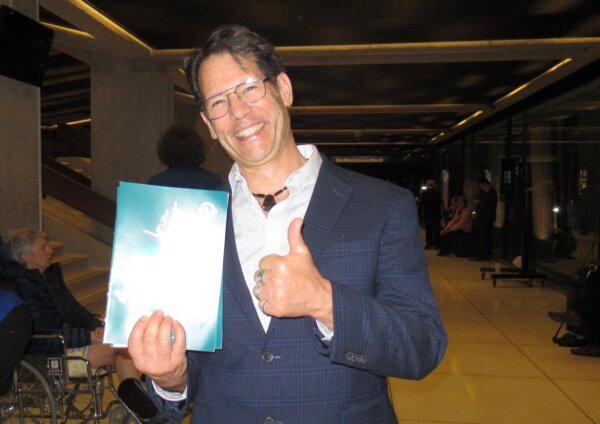

Dancing With a Humble Heart

Shen Yun dancer William Li reflects on the depth of classical Chinese dance: ‘It really comes from the heart’

Dancing With a Humble Heart

Shen Yun dancer William Li reflects on the depth of classical Chinese dance: ‘It really comes from the heart’

Epoch Readers’ Stories

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Wisdom From a Retired Cowboy Artist

I have lived the life of the sculptures I have made.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

The State of Our Unions: Marriage in America Today

The decline of marriage in the U.S. has deep-reaching implications—for individuals and society at large

Special Coverage

Special Coverage

Chemicals in Microplastics Can Be Absorbed Through Skin: Study

A new first-of-its-kind study shows that chemical additives in microplastics can leach into the body through sweat.

Chemicals in Microplastics Can Be Absorbed Through Skin: Study

A new first-of-its-kind study shows that chemical additives in microplastics can leach into the body through sweat.

How Art Is Helping Veterans With PTSD

Artist Tim Gagnon gives veterans a way to move forward in civilian life.

Original ‘Naked Gun’ Director David Zucker: ‘To make fun of the left, you really can’t do that in Hollywood’

A master of the spoof genre, Mr. Zucker says studio executives are “overly sensitive.’

‘The Inner Circle’: Naivete Is No Excuse for Capitulating to Communism

Some choose not to listen to the warnings of communism’s treachery, but ignorance is no excuse to avoid the consequences.

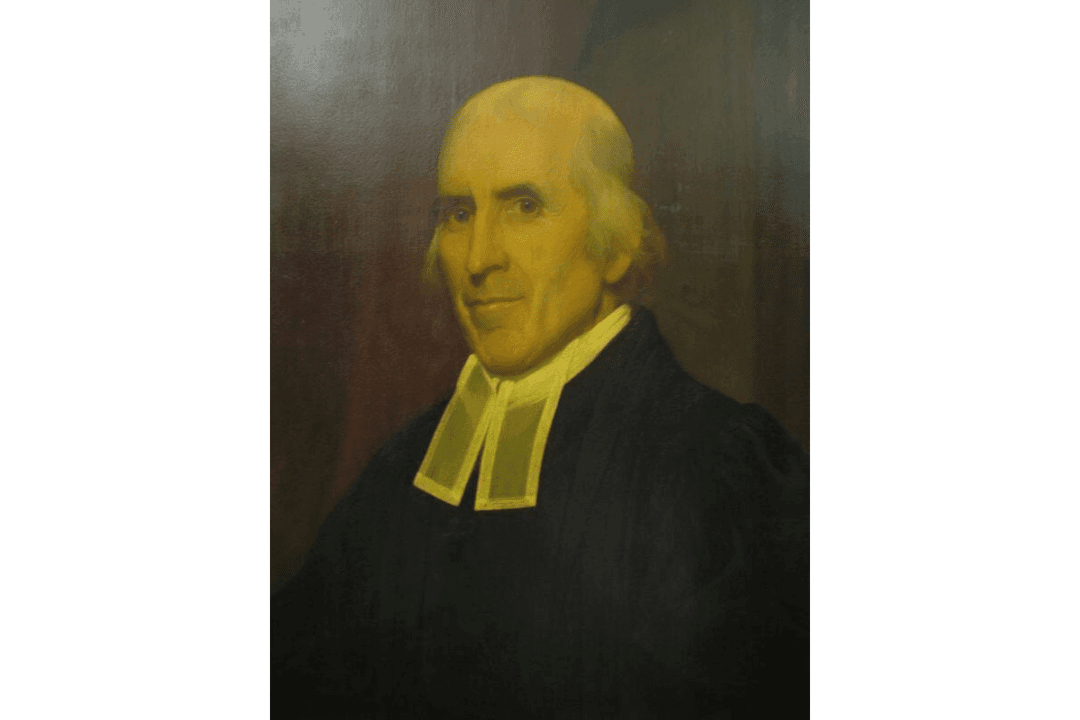

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

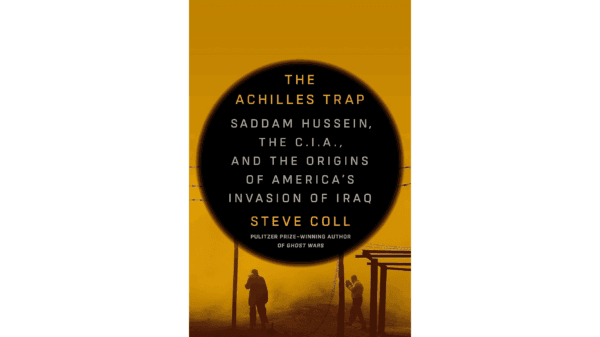

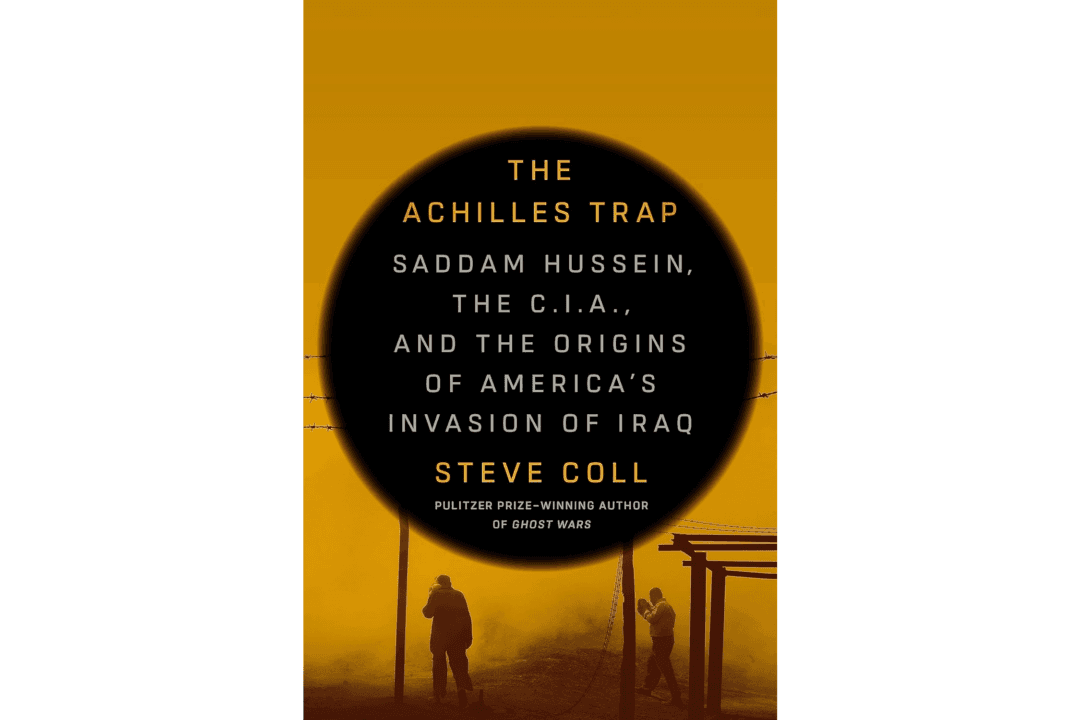

How the US–Iraq Relationship Devolved Into War

Decades of animosity swirl in Steve Coll’s ‘The Achilles Trap: Saddam Hussein, the C.I.A., and the Origins of America’s Invasion of Iraq.'

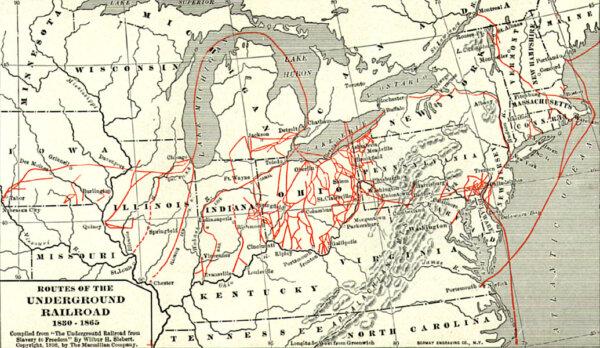

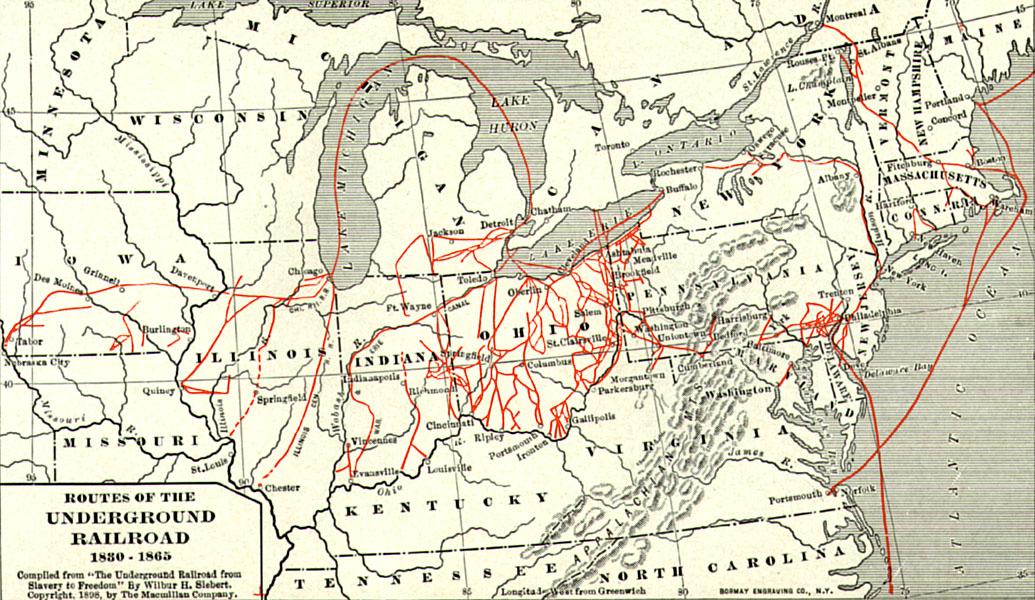

Important Players in a Divided Nation

Sons of the North, including young Spencer Kellogg, gave their all for the fight against slavery during the Civil War.

How a Minister’s Concern Birthed Our National Motto

In ‘This Week in History,’ US Treasurer Salmon Chase approved of an idea, early in the Civil War, that changed the history of American currency.

How Art Is Helping Veterans With PTSD

Artist Tim Gagnon gives veterans a way to move forward in civilian life.

Alcohol and Acid

The acidity of the wine determines how well it will pair with food but labels often say nothing of acid levels.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

Rick Steves’ Europe: Glimpse the Ancient Past in Northeast England

Romans built Hadrian’s wall 2,000 years ago to mark the northern border of their empire.

Ed Perkins on Travel: Solo Travel—Difficult but Improving

The travel industry is slowly making prices fair for true solo travelers.

![[LIVE Q&A 04/24 at 10:30AM ET] Media Raise Questions About Controversial Cloud Seeding After Middle East Floods](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635847-CR-TN_REC_0424-600x338.jpg&w=1200&q=75)